Asia | China | Emerging Markets | FX | Monetary Policy & Inflation

Asia | China | Emerging Markets | FX | Monetary Policy & Inflation

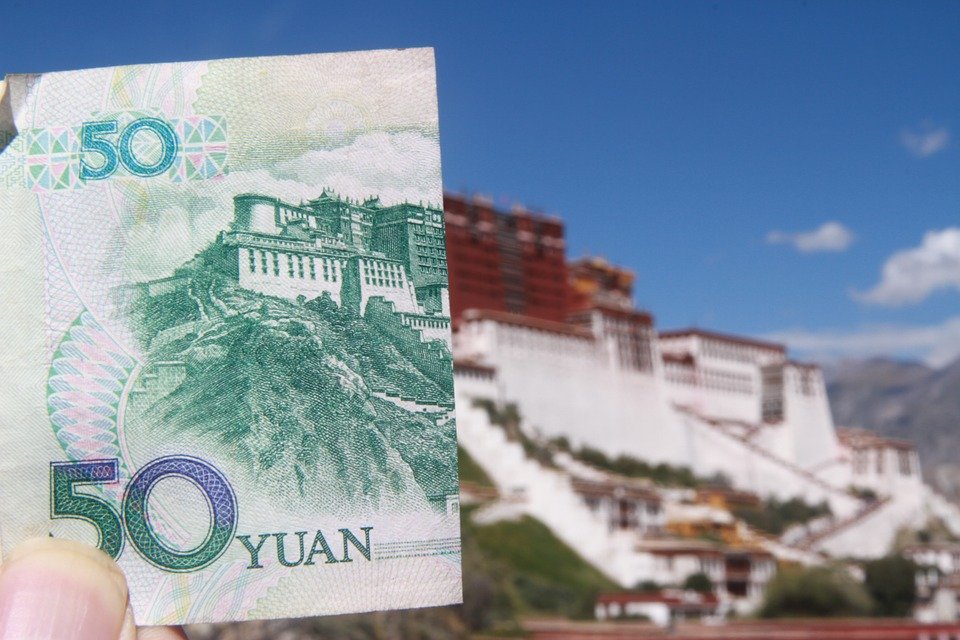

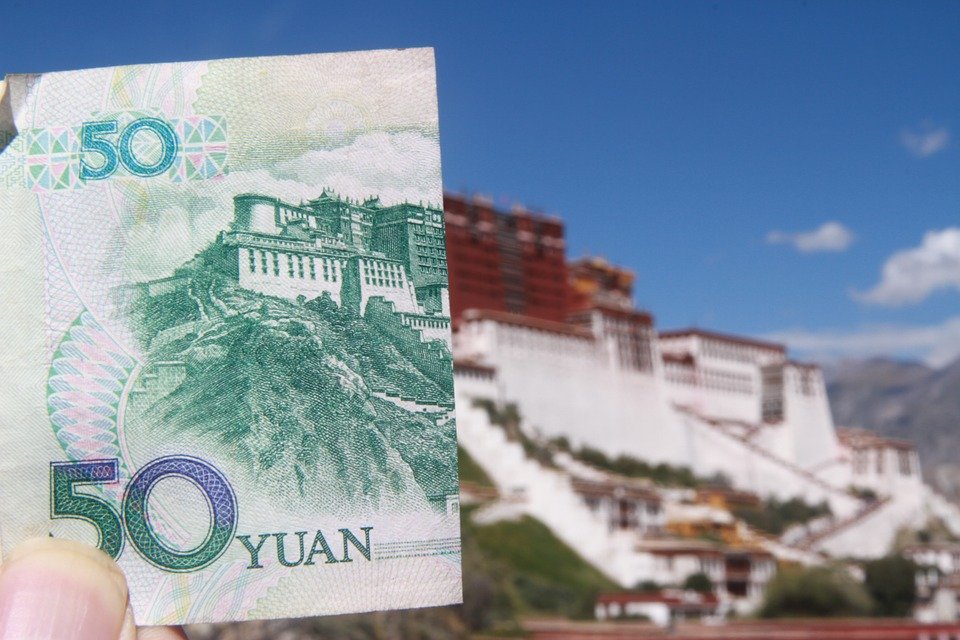

As the market waited for President Trump to announce dramatic punitive measures against China on 28 May, the RMB fell to its weakest point this year. However, the Trump administration balked at tearing up the Phase 1 trade deal. The RMB quickly stabilized and, I suspect, is poised to appreciate vs the USD.

I am not ruling out a re-escalation of trade tensions at some point in this election cycle. But in my opinion, there is no fundamental reason for USDCNY to rise significantly, except in the scenario where either side scraps the Phase 1 trade deal. As a core view, I am now cautiously bullish on RMB.

My reasoning is as follows:

The main reason for RMB weakness in the last two years was that the PBoC used FX devaluation to offset the effect of higher tariffs. This is very different from the 2015-16 period, where enormous and destabilizing capital outflows from China drove persistent weakness. In fact, net settlement flows in the last two years have been entirely within PBoC & SAFE’s control. FX reserves have remained stable. RMB devaluation in the last two years was a deliberate policy decision, rather than an intractable Balance of Payments problem.

This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

As the market waited for President Trump to announce dramatic punitive measures against China on 28 May, the RMB fell to its weakest point this year. However, the Trump administration balked at tearing up the Phase 1 trade deal. The RMB quickly stabilized and, I suspect, is poised to appreciate vs the USD.

I am not ruling out a re-escalation of trade tensions at some point in this election cycle. But in my opinion, there is no fundamental reason for USDCNY to rise significantly, except in the scenario where either side scraps the Phase 1 trade deal. As a core view, I am now cautiously bullish on RMB.

My reasoning is as follows:

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.