Equities | Monetary Policy & Inflation | US

Equities | Monetary Policy & Inflation | US

There is no sugar coating the grim reality. The failure of three banks within days last week has destroyed whatever credibility the regulatory establishment gained over the past 15 years to manage risks in the banking system.

The government response to prevent further bank runs has been to backstop all deposits at Silicon Valley Bank, and presumably Silvergate Capital and Signature Bank. Implicitly, this means all deposits are effectively backstopped. It would be nearly impossible for regulators not to extend this protection to all banks and deposits.

The bottom line? The US banking system has been effectively nationalized.

In the short run, markets seem to be relieved. After dropping 1.5% last Friday, the S&P 500 was up modestly on Monday, although bank equity indices were down 10% on Monday and 25% over the past week.

The crisis could pass in coming days if there are no further collapses. But it has exposed various fault lines in the banking system and economy, and these will likely continue to reverberate. We outline some of the obvious and still possible unintended consequences of the government’s action.

US bank regulators have spent 15 years building up a massive regulatory infrastructure in the wake of the 2008-09 financial crisis. Whatever credibility they gained is gone.

Barney Frank, one of the chief architects of the Dodd-Frank legislation, was also the chief cheerleader pushing Fannie Mae and Freddie Mac into their disastrous foray into subprime mortgages. Vision was obviously not his thing. It is little surprise that Dodd-Frank turned out to be nothing more than a full employment act for accountants and lawyers tasked with filling out reams of paperwork and checking boxes on checklists.

For all that busywork, Dodd-Frank failed to produce the kind of institutional initiative where regulators viewed Silvergate Capital, Signature Bank and Silicon Valley Bank as windows into highly stressed corners of the financial markets (Silicon Valley and crypto). Rather, they apparently blindly followed standard operating procedures that said those banks were too small to merit that kind of attention.

More damning, the stress tests that major banks are subject to focused primarily on recession risks, with scant attention paid to interest rate risk. It was as if the experience of the 1980s, when the thrift industry collapsed under the weight of rising rates, had been excised from institutional memory.

None of this is likely to inspire confidence in regulators’ abilities to manage this crisis, which is making it worse than it might have otherwise been – if it had even occurred.

In another example of regulators failing to think before acting, reports suggest banks outside the US with unrealized losses are coming under pressure. Depositors are apparently looking to transfer funds to US banks to capitalize on what is effectively an unlimited backstop on deposit insurance. It is anyone’s guess where this ends up, but even hints of destabilizing the global banking system must be a concern.

The government has gone to great lengths to assure the public that taxpayers will not bear the cost of backstopping deposits.

Let us unpack this. The FDIC collects an insurance premium from every bank with insured deposits. On Friday that premium covered up to $250,000 per account. Now that coverage is effectively infinite, the FDIC will have to raise bank insurance premiums, as required by law.

Where do banks get the money to pay premiums? From revenues generated by their banking business. Those revenues come from fees charged to customers, and the spread between income on assets and rates paid to depositors. If the bank needs more revenue to cover costs, they raise fees and cut deposit rates.

Who pays higher fees and earns less interest on deposits? Taxpayers. As a last resort, banks could cut dividend payments to shareholders. But they, too, are taxpayers.

There is no escaping that reality. As bank customers (i.e., taxpayers) realize what is happening, political pressure may rise on banks and bank regulators, with unpredictable results.

How are depositors likely to respond if fees rise and the gap between market rates and deposit rates keeps growing? We can reasonably expect deposits to start trickling out of the banking system into money market funds that pay close to market rates.

What if bank regulators finally wake up to the reality of interest rate risk? Banks hold about $8 trillion in securities, of which more than half has maturities longer than 10 years according to Federal Reserve data. Unrealized losses on securities are probably in the $1.5-2 trillion range. What if regulators require banks to raise capital to cover that shortfall? Bank equity returns will collapse. How will banks try to boost profitability? More fees and lower deposit rates for starters.

At that point, the trickle of deposits out of the banking system could turn into a torrent.

If not more capital bank regulators could impose other costly limits on banks in return for expanded deposit insurance.

Just in the past few weeks there have been high-profile defaults on commercial real estate mortgages by Blackstone, PIMCO, and Brookfield.

Banks hold about $2.8 trillion in commercial real estate mortgages. There has been little mention of problems with bank commercial loan holdings. If high-profile lenders are running into trouble, it is just a matter of time before investors starting probing into this sector.

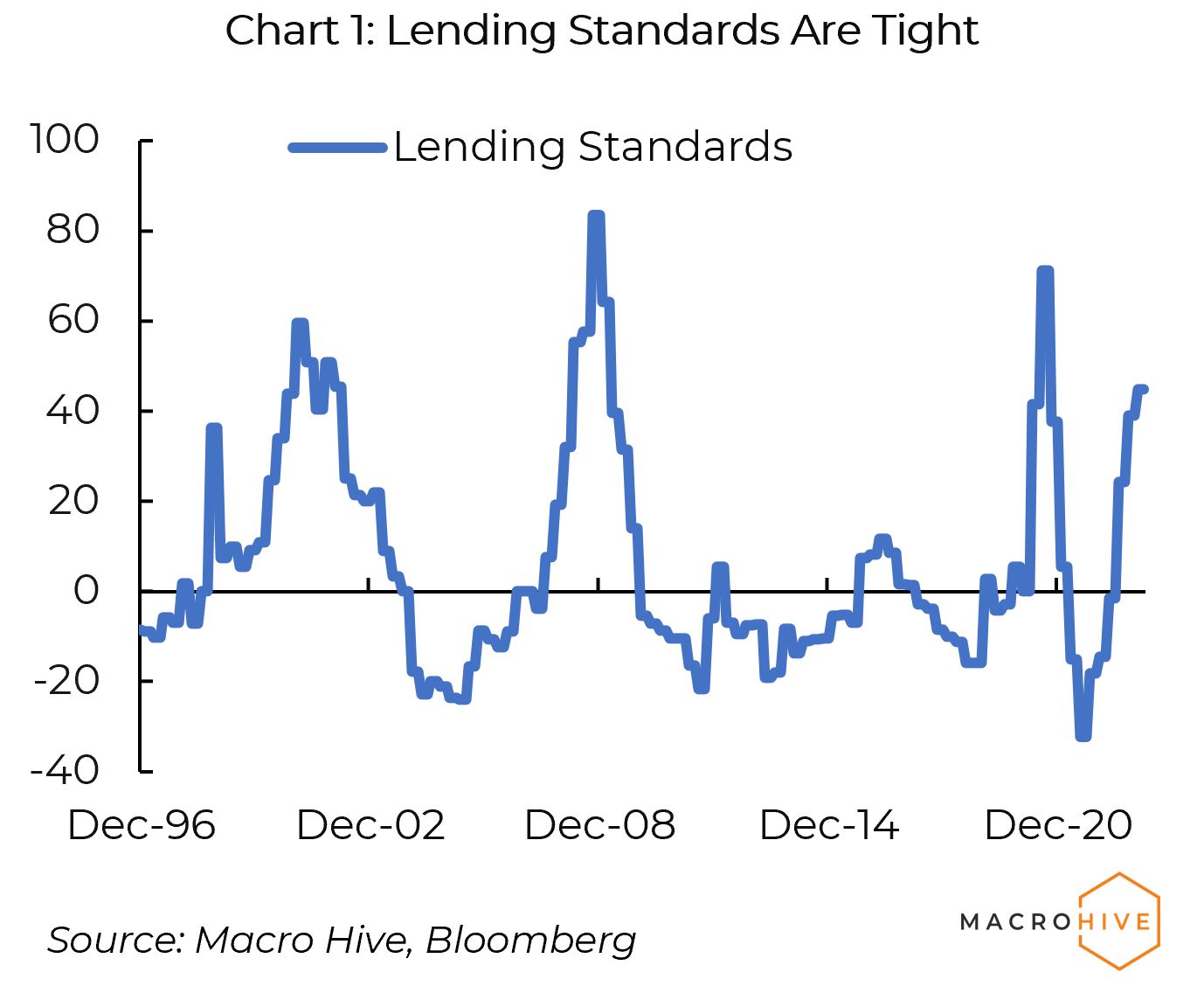

Banks have already significantly tightened bank lending standards in response to rising rates (Chart 1). A combination of economic and regulatory uncertainly could lead them to tighten further, with knock-on impacts on the economy.

So far, the focus has been solely on the banking system. But the nonbank system has boomed since the financial crisis, in no small part due to the onerous (and mostly non-economic) regulatory burdens of Dodd-Frank.

We must assume nonbanks are active in the same space as Silicon Valley Bank, Silvergate Capital and Signature Bank. No one knows who they are, or what stress they may be under.

Meanwhile, the bank regulatory establishment is only beginning to think about talking about what is happening in the nonbank sector. And talk is a long way from action. If a crisis is brewing in the nonbank sector, bank regulators will not be the first to know about it. It would be a stretch to imagine they have a clue how to deal with it.

As noted above, bank equities are down sharply over the past week. If the system makes it through the next few days without another crash, bank equities could well bounce on relief that a major bank run has been (hopefully) averted.

But, a nationalized bank system will not be as efficient or profitable as the previous private model with some government oversight. The oft-mooted 15% target return on equity? The only way investors can hope to realize that is by buying bank equities at significantly lower prices. Tough noodles for current bank investors.

The 2-year Treasury rate has dropped more than 100bp to 4% in the past few days. The 10-year Treasury yield is down 45bp to 3.55%. Markets are clearly convinced that the Fed will turn from fighting inflation to saving the banking system – or at least put inflation on the back burner.

Various poorly understood structural forces may lower inflation sooner rather than later and everything will work out. Or the Fed may lose control of the fight – or ‘win’ by bringing on a recession and rising unemployment through its handling of this latest banking crisis.

At the very least, the economic outlook for the rest of the year is cloudy, with risks probably tilted to the downside.

We have laid out a possible if pessimistic scenario of how things might develop in coming days and weeks.

Reality will probably play out a bit differently. But it could very well rhyme.

The current crisis may become a two- or three-act play, and soon largely pass. But given all the other issues raised by the crisis, it will likely turn into a daily soap opera that runs for a long time.

Photo Credit: depositphotos.com

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.