This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

Summary

- The S&P 500 (SPX) and NASDAQ (NDX) added to the gains of the previous week, but the Russell 2000 (RTY) faltered on rate concerns.

- We are constructive on the outlook for equities going into yearend but the weakness in small caps is a lingering concern. It shows how uneven the recovery is and how quickly the economy could deteriorate if unemployment starts rising.

- The latest batch of earnings shows people are still spending on experiences, and that the pickup in business advertisement spend – an indicator of near-term confidence – is real.

- Retailers headline the list of companies reporting this week. Bellwethers include Home Depot, Target, and Walmart.

- In the tech sector, investors will watch how Cisco Systems (CSCO) plans to hop on the artificial intelligence bandwagon.

Market Implications

- We still think the homebuilder ETF XHB and regional bank ETF KRE will outperform if rates fall further. Even if rates do not fall, these ETFs should outperform over the medium term as long as the economy does not outright collapse.

What We Learned Last Week

As we expected, large cap equities managed to hold their 6% gains of the previous week and even notched another meaningful uptick, with SPX up 1.3% and NDX up an impressive 2.8%. These indices are now up 7.2% and 9.5%, respectively, since late October (Chart 1). Indeed, NDX is near its June high and SPX is close to where it was when the 10yr Treasury yield crossed 4.5% in late September.

Small Caps MIA – All we need to believe that this market is on a roll through yearend is confirmation from the small caps – which seem to be missing in action. RTY outperformed when rates first fell, but then gave back 3.2% last week, apparently on concerns about Federal Reserve Chair Jerome Powell’s comments about raising rates if necessary. There were also some soft earnings. RTY is in danger of testing its 2023 low.

Squeezing the Little Guy

This is a pattern we see in the economy too – higher-income people and businesses that cater to them are doing well, but most indications are that people in the bottom two-thirds of the income spectrum are struggling, as are the retailers that cater to them.

It is difficult to be bearish on either equities or the economy when we are near full employment and GDP growth is robust. Simultaneously, the uneven nature of the recovery is cause for concern – if the economy slows and unemployment starts rising, the slowdown could be more abrupt than the headline numbers might imply.

Recent Earnings – More of the Same

Earnings last week offered further confirmation of what we have seen so far. With Q3 earnings season winding down, the SPX and NDX are reporting average beats of 7.6% and 10.2%, respectively.

Media companies dependent on advertising are still mostly reporting advertisement revenues above expectations, including The New York Times (NYT) and News Corp (NWS), following Alphabet (GOOG), Meta Platforms (META), and Spotify (SPOT). The one notable exception was Warner Brothers Discovery (WBD), which relies on advertising on broadcast TV. We view rising advertisement spend as an indication of rising business confidence in the near-term outlook. But both GOOG and SPOT mentioned that advertisement volumes fell after the Israel-Hamas war began on 7 October.

We still see consumers spending on experiences, with TripAdvisor (TRIP) and MGM Resorts reporting much better than expected results.

Still Long Interest Sensitive Names

Homebuilder DR Horton (DRI) reported stellar results in both profits and demand for its houses, despite the rising rates environment. We have argued repeatedly that today’s homebuilding industry is nothing like it was in 2006-08. Homebuilders today mostly build to order; they do not buy land and build on ‘spec’, and risk getting caught with large unsold inventories. Volumes may drop as rates rise, but homebuilders can still operate profitably.

The homebuilder ETF XHB should outperform on any further decline in rates. Even if rates do not fall in coming weeks, we think XHB is a good medium-term hold.

We note that XHB holds homebuilders and other companies related to homebuilding, such as retailer Home Depot and mortgage companies, which may underperform as rates rise. Investors could capture more upside by holding homebuilder equities directly.

The regional bank ETF KRE will also outperform if rates fall further. Barring an economic collapse or major rise in rates, we see limited downside for regional banks. Even if rates do not fall, we expect KRE will outperform as it becomes apparent that most regional banks have solid business models.

The Week Ahead

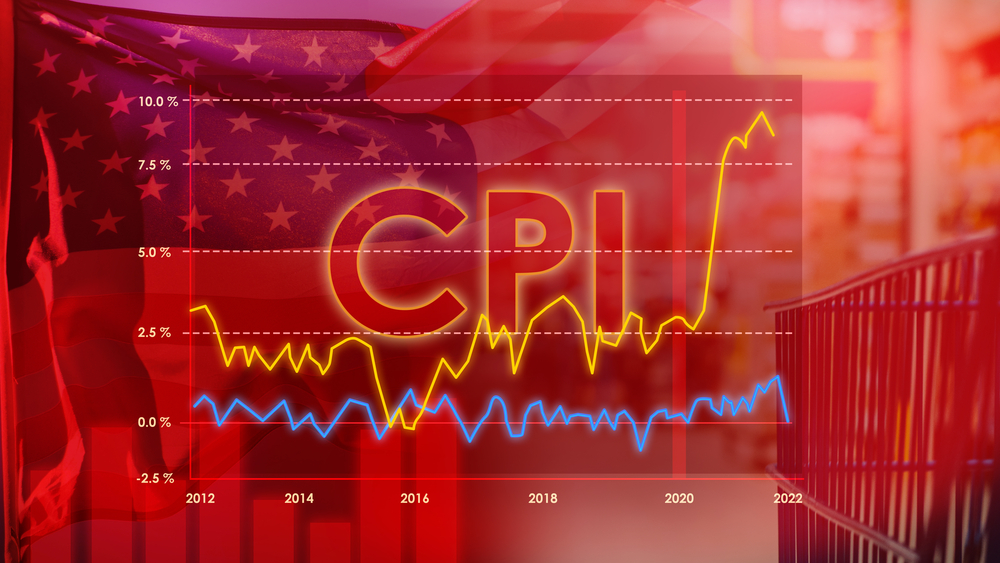

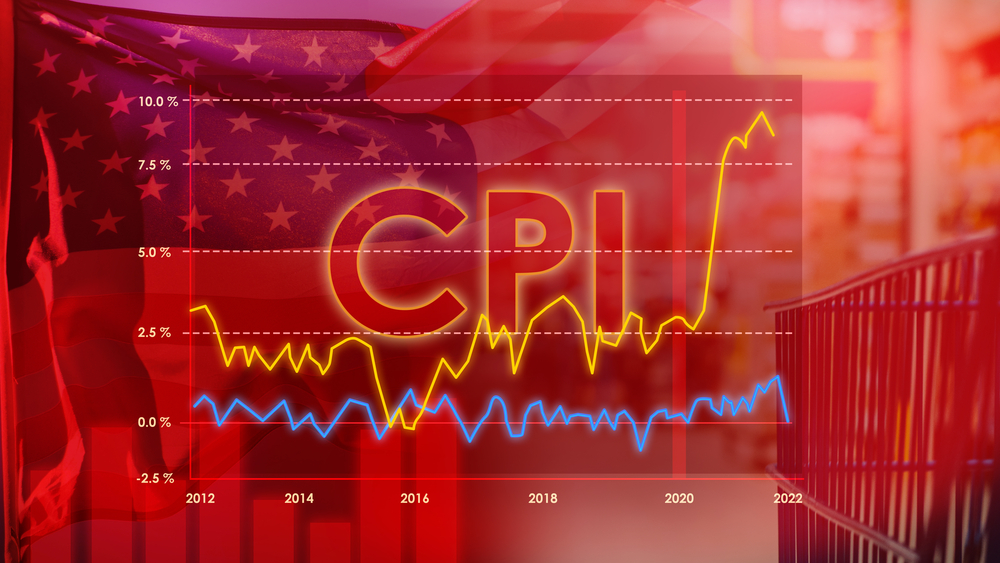

The big economic release of the week will be Tuesday’s CPI report. That will make or break the rally – and whether it can continue. Wednesday’s retail sales and PPO reports will be afterthoughts.

Several major retailers report this week, including Home Depot (HD), Target (TGT), Walmart (WMT), and Macy’s (M).

We will get another read on consumers’ appetite for stuff – and whether retailers are making money whatever consumers are – or are not – buying. We should also hear about their expectations for the holiday season. Several companies, including toy makers Hasbro (HAS) and Mattel (MAT) said orders for holiday toys have been weak. But spending on Halloween hit a record $12.2bn this year, so people are still willing to spend on special occasions. We suspect holiday spending will be solid – but people may opt to spend on experiences rather than stuff.

Only about 30 companies report this week. All the better to pay close attention to how retailers are doing, and what they have to say.

Monday

- Tyson Foods.

Tuesday

- Home Depot (HD).

Wednesday

- Advance Auto Parts (AAP).

- Cisco Systems (CSCO).

- Target (TGT).

- TJX Cos Inc. (TJX).

Thursday

- The Gap (GPS).

- Macy’s (M).

- Ross Stores (ROSS).

- Walmart Inc. (WMT).

Friday

- BJ’s Wholesalers Co. (BJ).

- Johnson Controls (JCI).