This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

Every week, we bring together our community of macro experts to discuss the latest market developments. In this piece, we distil the insights from our conversations up to 17 May. These are views from our network rather than the views of the Macro Hive research team. ‘[Day]’ indicates the day the comment was made.

US

Pricing of Fed hikes [Thursday]

- A member of our network said that the 75bps July FOMC probability is all but eliminated. Still, over 100bps of hikes for the two upcoming meetings is priced. Maybe the risk-reward is not too bad to try and play for 75bps over those two meetings?

- Another disagrees on the grounds that the assumption that a dovish Fed is pro-risk may not hold. What is happening may be exactly what the economy needs; orderly deleveraging and dampening of demand through the wealth effect and reduced confidence. What it doesn’t need is a dovish central bank bailing it out again. In such a situation, what would inflation expectations look like then?

- But the market is pricing 108.1% of 100bps over the next two FOMC meetings. This participant thinks we get 100bps, but that the market will start trading that probability at 80-90%.

- Dominique thinks we get 50bp hikes until September. If things get disorderly, maybe they adjust the pace of QT first?

Equities

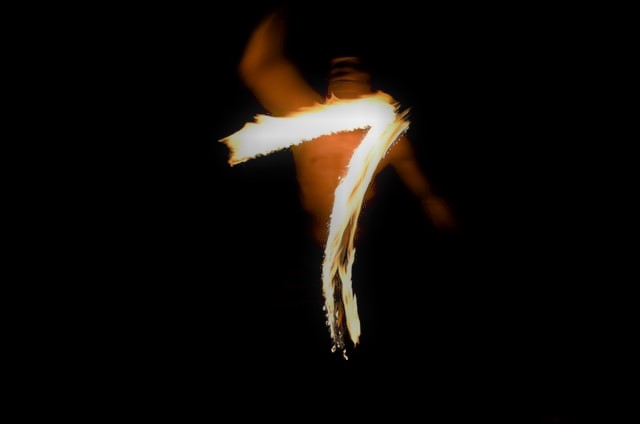

- Historical trends have our participants interested: going back to 1957 a decline of 15% or more for the S&P500 has been followed by positive returns in the ensuing 12 months in all but two occasions.

Source: Lawrence Hamtil (@lhamtil)

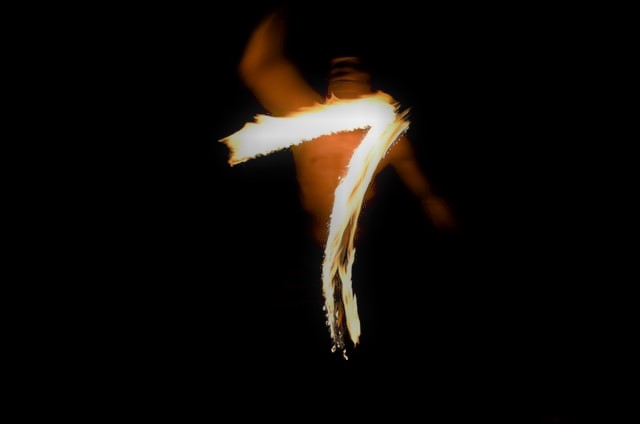

- Meanwhile, this has been the fourth worst start to the year for the S&P500 since 1930.

UK

UK employment data and markets reactions

- An opinion raised was that, given the cost-of-living crisis the UK is currently undergoing, with public sector pay exhibiting the worst decline in real wage growth since records began, forcing wages down to avoid a wage-price spiral (though the interest rate lever) seems like the wrong thing to do.

- The data goes against a lot of anecdotal evidence one of our network has (firms struggling, sales slumping etc.). UK employment has been extraordinarily strong versus other data points. But they struggle to see why there is such a hiring frenzy given the economic backdrop. Even so, there is little desire to fight the data right now.

- Another member thinks the market is full of hope still for a good outcome. Now it’s all about the inflation peak enabling the better outcome. They think the probability of this is low, but this is a local sweet spot for assets given the puke price action of the past weeks.

Inflation

- One member of our network believes that the pain is self-inflicted through sanctions and tariffs. If you want to take inflation down, start there.

- Another member disagrees, they argue that while sanctions and tariffs are important, if they were crippling then employment wouldn’t be at a record. Everything is COVID-19 and war related, but it’s within a policy setting context that goes way back.

Without foreign direct investment the UK BoP will become problematic

- One member states that Russians are no longer investing, and you would suspect high property sales have slowed dramatically.

- Brexit is only starting to bite now.

What happens if you were to sell 10bn GBP now?

- What was interesting about doing those big orders back in the day was that you could hit an area of the market and suddenly there is incredible liquidity. Now it seems there’s less liquidity today for large orders, but much more for small orders.

China

The implications of USD/CNH breaking 7.00

- One member believes that if it happens, it would be very bad for risk. There is a perception that both this CNH selloff and the China lockdown are finite over time. A push up through 7.00 would be a bigger devaluation than in 2015. It would suggest that China is in deep trouble with its economy; deeper than we now believe. Besides, 7.00 has always been a trigger point for turmoil in Chinese markets. We have been above there a couple of times and it didn’t work out well for risk.

Commodities

Could oil break this huge range now and run back to 70? [Thursday]

- The view among participants was that it would be very positive for risk assets. It’s just hard to decide where to put the stops for bearish trades, or bullish trades for that matter.But really, it’s an inflation hedge unwind. The market is trapped. It got herded into strategies and trades.

CFTC Commodity Futures Pricing and Futures Curve

- The week-on-week pricing belies the drama that oil has seen, with tons of intra-week volatility. However, broadly energy was neutral on the week, metals were all negative, while softs, livestock, and agriculture were broadly up. Maybe this means that the market continues to have concerns on a slowdown and concerns over food supplies.

Cryptocurrency

Bitcoin price action has been interesting

- It bottomed-out before stocks on Thursday but didn’t participate at all in Friday’s positive moves. It is hard to get bullish on bitcoin here

Is it easy to get your money back into USD from a stablecoin?

- Some stablecoins claim they are backed one-to-one, and they are audited, even though they don’t specify all the details of their USD holdings. Others aren’t backed one-to-one but have ingenious schemes behind them supposedly guaranteeing a one-to-one rate to the USD.

Knock on effects of Luna

- Our network has noted that a lot of Asian hedge funds got completely wiped out by Luna, especially in Korea. A top ten coin gone in three days.

A second podcast on the bad side of cryptocurrency: This Is How the Terra Stablecoin Actually Imploded (1 hour 14 minutes)

- It’s hard not to make a judgement, but it seems there is a change of tone by the ‘insiders’.

Are there opportunities?

- There are no doubt a ton of garbage projects in crypto and also in the NFT space. Anyone outside of the US can spin up an idea and sell it. A member of our network was told about an NFT project in Asia, great marketing, spun-off as something similar to a Pokémon collection. The NFTs sold for $6k, and when they came out it was a complete flop, but they raised $50-60mn. This is just one example of hundreds.

- A lot of TradFi firms are looking at options, while a lot of hedge funds are trying to get option strategies up and running. Given the implied vol of the space compared to TradFi, there are certainly opportunities.

Trade Ideas

- Short EUR/JPY [Tuesday]. The ECB is more wrong than the BoJ.

- Short Ethereum [Thursday]. Probably has more to go.

- USD/CNH to break 7.00 though not a base case [Thursday].

- Long EUR/GBP and short GBP/USD [Friday]. There were very large GBP buy flows on Friday with bad news to follow. Giving good entry.

Read, Listen, and Watch

Read

Listen

Bilal Hafeez is the CEO and Editor of Macro Hive. He spent over twenty years doing research at big banks – JPMorgan, Deutsche Bank, and Nomura, where he had various “Global Head” roles and did FX, rates and cross-markets research.

Ben Ford is a Researcher at Macro Hive. Ben studied BSc Financial Mathematics at Cardiff University and MSc Finance at Cass Business School, his dissertations were on the tails of GARCH volatility models, and foreign exchange investment strategies during crises, respectively.

(The commentary contained in the above article does not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.)

Enter your email to read this Macro Hive Exclusive

OR

START 30-DAY FREE TRIAL

Already have a Macro Hive Prime account? Log in