Summary

- The firm labour market all but guarantees the Fed will raise rates at least several more times.

- We continue to think the combination of high inflation and higher rates will hurt earnings in coming months. We reiterate our equity underweight view.

- Tech companies catering to corporate and industrial demand continue to report strong earnings and outlooks. Watch closely – should this one bright spot slow, that may be when we are on the brink of recession.

- Only 11 companies report this week – among them, small but high-visibility GameStop Corp and super-sized grocer Kroger Co.

This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

Summary

- The firm labour market all but guarantees the Fed will raise rates at least several more times.

- We continue to think the combination of high inflation and higher rates will hurt earnings in coming months. We reiterate our equity underweight view.

- Tech companies catering to corporate and industrial demand continue to report strong earnings and outlooks. Watch closely – should this one bright spot slow, that may be when we are on the brink of recession.

- Only 11 companies report this week – among them, small but high-visibility GameStop Corp and super-sized grocer Kroger Co.

What We Learned Last Week

Despite the Fed’s increasing efforts to contain inflation, the US labour market and industry are chugging along. Employers continue to add workers. The manufacturing PMI and ISM remain comfortably above 50. Job openings, as measured by the Jolts index, remain near all-time highs. That, along with rising labour participation (62.4% vs 62.1% previously) and unemployment (3.7% vs 3.5%), suggests most of those new entrants should soon find work.

A firm labour market in turn implies rising income, rising demand, and the prospect that the Fed must indeed keep raising rates to contain inflation.

Equities appear cognizant of this risk, with the S&P 500 declining 2.5% last week and 1.1% on Friday after the employment report.

We continue to think the pressures of inflation and rising rates will hurt earnings during 2H, and push equities lower, although timing is an open question. We reiterate our underweight recommendation.

Earnings Mixed Again

Earnings reports in the consumer staples sector were mixed. Hormel Food Corp (HRL), maker of various brand-name food products and meats, reported strong earnings but weaker-than-expected revenue and earnings in 2H due to rising cost pressures. Campbell Soup Co (CPB) reported earnings and outlooks solidly in the middle of expectations.

In the sensitive consumer discretionary sector, Lululemon Athletica (LULU) bucked the trend with earnings and outlooks significantly stronger than expected. As people return to the gym and get out more, they want to look good! Somewhat surprisingly for a discount retailer, Ollie’s Bargain Outlet Holdings (OLLI), which markets closeout brand name goods, came up short on earnings and outlooks. This was apparently because of its inventory mix – perhaps weighted more to pandemic rather than post-pandemic tastes.

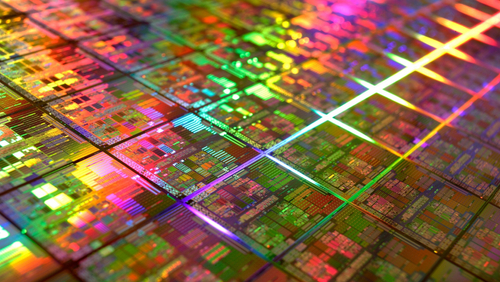

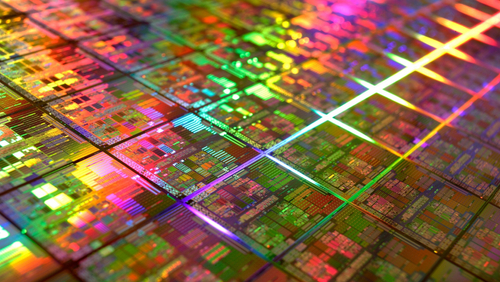

Broadcom Inc (AVGO), maker of semiconductors and related equipment for industrial companies and the internet, reported an earnings beat and good outlook. This continues a pattern: semiconductor/tech companies focused on industry face strong demand and difficulty meeting it, while those focused on consumer products that were popular during Covid lockdowns are doing poorly.

Industrial Demand for Semiconductors Is the New Canary in the Coal Mine

For example, the auto industry could all but surely sell far more cars monthly than its recent run rate near 13.1 million (annual rate). But an ongoing shortage of suitable semiconductor chips is slowing production and keeping used car prices sky high (Chart 1).

When we see auto production rising to pre-pandemic levels and used car prices coming back to Earth, that may indicate things are finally returning to something like normal. And, if we see demand for industrial-type semiconductors drop off, that may be the canary in the coal mine signalling that recession is inevitable.

Light on Earnings Next Week

A scant 11 companies are slated to report earnings in the coming week.

Wednesday – GameStop Corp (GME) – everyone’s favourite meme stock – reports. Its market cap may only be a modest $8.3 billion, but it is sure to attract far more attention than many far larger companies.

Friday – Kroger Co (KR), the super-sized grocery store company, will tell us more about what consumers are buying and if it can maintain its margins. As a major fuel retailer, KR may also have some interesting comments about how driving habits are changing.