US

Key Points:

- The mediocre NFP has not changed my expectation of no change at the Dec 16 FOMC.

- A compromise stimulus of about $0.9tn is likely to get adopted by the end of the week.

Fed

The pre-meeting blackout is in force this week. I still expect the Fed to stay on hold at the Dec 16 meeting, though my conviction has been weakened by the poor NFP. This week’s comments by the Chicago and Dallas Fed presidents show that more clarity on the outlook is needed before the Fed moves, again a point in the direction of no change. Other news in that direction include a much more likely fiscal stimulus deal, possibly clinched ahead of the FOMC meeting (see below), as well as Chair Powell for the first time implicitly acknowledging that the vaccine had changed the outlook in this week testimony to Congress.

In addition, the Fed is likely to announce its long expected “outcome based forward guidance” for LSAPs, which it could try to pass as a form of easing.

Data

My NFP expectations of 600k were way off, which told me two things. Firstly, in contrast with previous months, NFP unemployment fell by much less than unemployment claims. It could reflect that the decline in claims reflects to a greater extent a loss of benefits eligibility, rather than new jobs (see Weekly claims point at risks of negative Q4 growth, 5th November, 2020). Secondly, the NFP slowdown seems out of sync with other recent data that does not signal as much of a slowdown. This is consistent with the recent pick up in productivity (in BBG PRODNFMH index): employers are hiring more slowly than their businesses are recovering. If so, this supports my view of core PCE remaining in a 1.5 to 1.75 range next year.

The NFP does not change my overall bullish view as any QoQ contraction in Q1 would be shallow and markets would likely look through it (see 2021: A banner year for risk assets?, 3rd December 2020). In addition, the stimulus negotiations have restarted, with a deal likely to get clinched by the end of the week (see below).

Furthermore, despite the sustained exponential growth in cases and the filling of hospital capacity. The Economic Policy Uncertainty Index (in BBG EPUCUSD index) seems that it is about to break its range as well as the Dallas Fed Mobility Index, if it was not for Thanksgiving, when Americans stayed home. The public is not paying attention to health officials, possibly due to lockdown fatigue, unclear and inconsistent guidance from health officials, as well as the fact that most Americans have not experienced a loved one getting very sick with COVID. This suggests scope for more efficient policies and communications, possibly as a new administration takes over, which is also bullish.

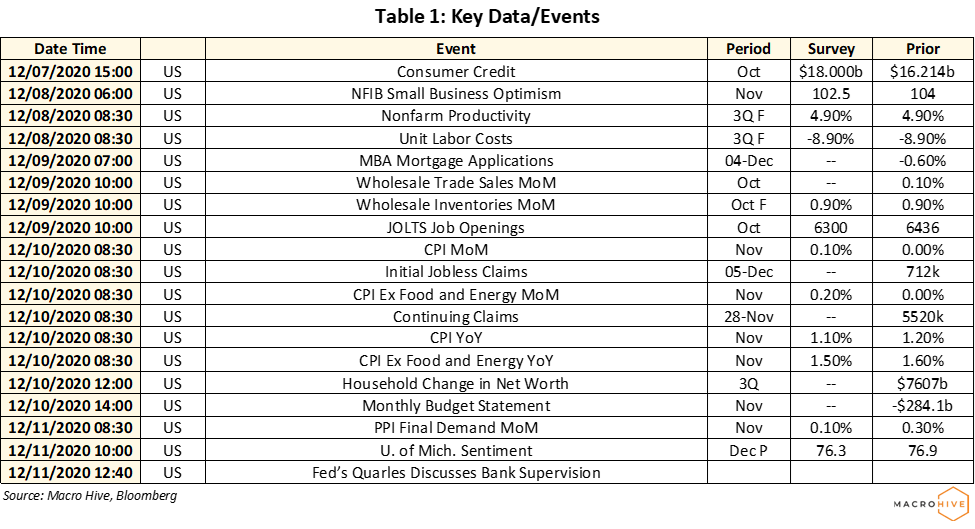

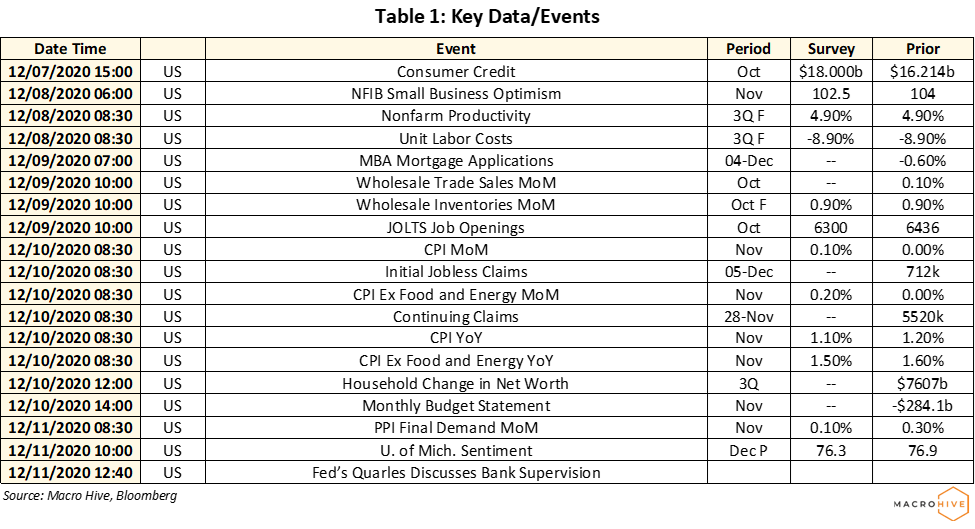

Most important data this week are the NFIB, JOLTS, CPI and U Mich. The Fed will publish the 3rd quarter flow of fund data that will give a sense of the sectoral distribution of the continued increase in M2 and of equity and credit market flows (see M2 spike unlikely to fuel CPI inflation, 29th October 2020 ).

Events/Elections

The key development this week was the newly found willingness of Senator Schumer and Speaker Pelosi to compromise on a $0.9tn stimulus package. I believe such a stimulus is likely to get passed by the end of the coming week as:

- What prompted the change of heart of Speaker Pelosi seems to have been pressure from President-elect Biden.

- There are enough Democratic and Republican senators to support the bill, even if some GOP senators are not supportive.

- President Trump will likely sign the bill as he still harbours political ambitions and will want to use his remaining time in office to pass popular measures with voters.

Betting odds of a democratic controlled senate (in BBG PRITUSSD index) have continued to increase this week though they remain around 30 pct.

Links to New York Fed POMOs/TOMOs: Repos, Treasury, MBS, CMBS

Links to New York Fed POMOs/TOMOs: Repos, Treasury, MBS, CMBS

G20

The key event of the week will be the ECB meeting where President Lagarde is expected to add to the bond purchase program. The BoC will also be meeting and the ECB Hernandez de Cos will be speaking in the Spanish parliament.

Key data releases will include Germany’s Zew survey as well as China’ CPI, PPI , external trade, credit and FX reserves.

Links to BOJ Rinban , BOE OMO

Links to BOJ Rinban , BOE OMO

COVID-19 Monitoring