US

Data

This past week there was an inconsistency between mobility and economic data. The mobility data was largely flat, as one would expect with states reversing or stalling their re-openings. At the same time, all the key data, ISM surveys, labor market (ignoring the v noisy ADP), factory orders, even Ward auto sales, surprised on the positive side. The NY Fed weekly economic index also inched up. Because the surprises were all on the positive side this seems unlikely to be noise, although not impossible in view of the data issues associated with v deep economic disruptions. I am giving the noise scenario a 25 pct probability.

The other scenario is that the economy is continuing to recover despite the recent surge in cases and new restrictions on businesses. A continued recovery would reflect exceptionally large government support, v loose financial conditions, more businesses finding ways to work around regulations/lack of compliance with regulations, expiration of large unemployment benefits that were a disincentive to go back to work, decline in households risk aversion and precautionary savings. The latter is supported by the most recent data on household spending and income showing the savings rate coming down from very high levels, but the last data point available is July. I am giving the recovery scenario a 75 pct probability.

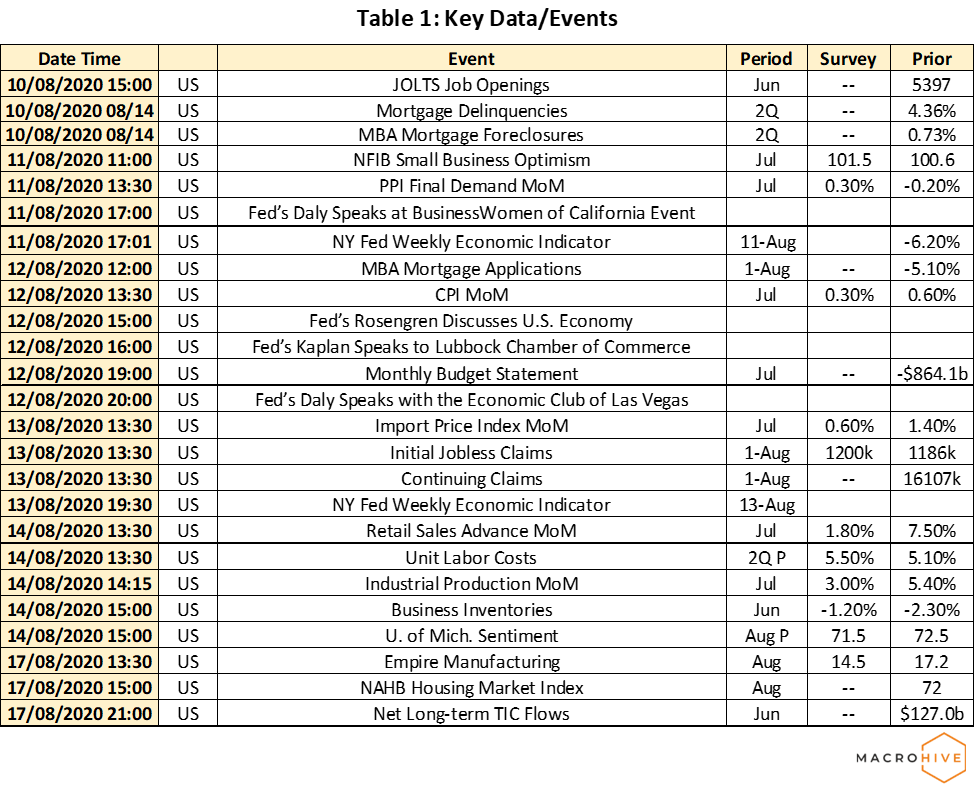

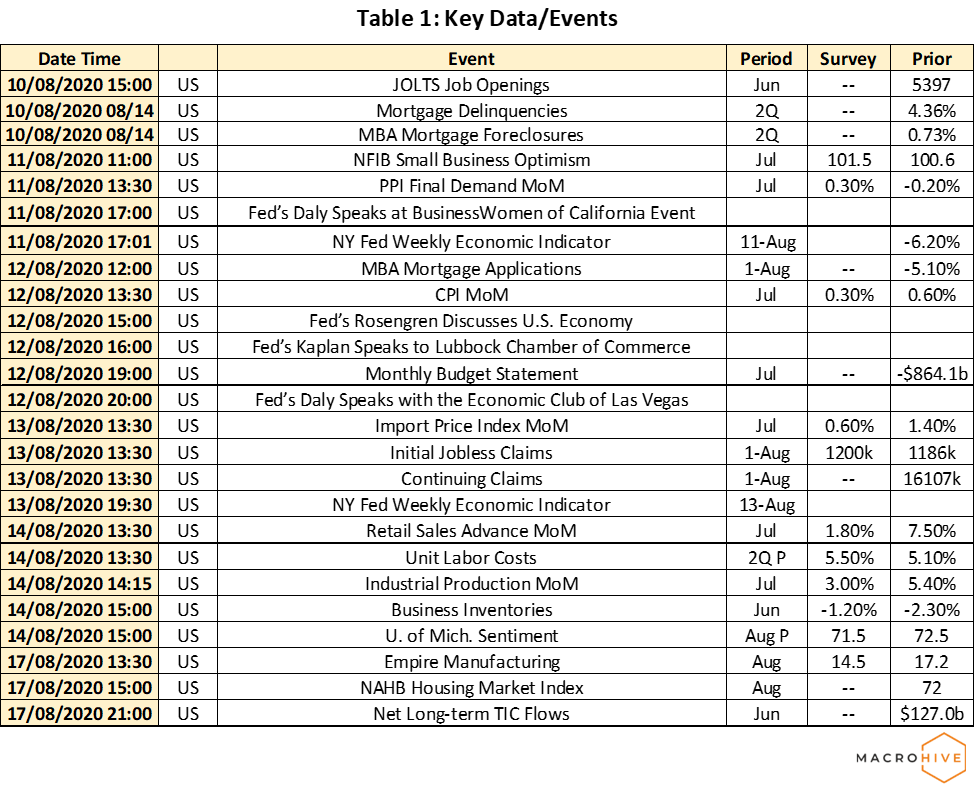

This week’s data will give us more clues on which scenario is likely: esp. the hard data i.e. weekly claims and NY Fed WEI, retail sales as well as soft data i.e. NFIB, U Mich, Empire surveys.

Events

President Trump executive orders maintain the status quo. Through limited unemployment benefits, eviction protection, and payroll tax and student loan deferrals they provide less support to the economy than could have been available under a bill voted by Congress. Overall they are unlikely to provide much support to the economy because of their limited scope and of the uncertainty surrounding their implementation. For instance employees could decide to not take advantage of the payroll tax deferral in order to avoid the build up of a large tax liability in early 2021.

For the current negotiations stalemate to end, the balance of power between Democrats and Republicans needs to change. This is unlikely to happen through the executive orders that, while depriving the Democrats of their main leverage, preventing further support to be channeled to the economy, do so only over a limited time period. For instance the extension of unemployment benefits is funded out of the Disaster Relief Fund that is likely to be exhausted after a month. I do not expect the Democrats to sue the administration as they could appear as the stooge depriving the American people of much needed support.

A change in the balance of power is more likely to come through a worsening or strengthening of the economy with the latter benefiting the Republicans since a stronger economy would lessen the need for further stimulus. For the democrats, the worse scenario would be a pick up in economic activity if for instance, workers go back to work in larger numbers now that unemployment benefits are less of a disincentive to work or if new cases continue to fall and public fear of the disease abate. In any event, the negotiations are likely to resume after the August congressional recess, when there will be more clarity on epidemic and economy.

VP Biden disappointed by not announcing his VP choice this past week but likely will oblige this week as the Democratic convention is starting on Monday 17th.

China and the US are expected to start their review of the phase 1 agreement around end-week, which is likely to be contentious given the recent US measures. These include: sanctions on officials involved in the Hong Kong crackdown (though the US stopped at the red line of sanctioning politburo members); threatening to delist Chinese companies that do not meet US auditing and accounting standards; shutting down Wechat and Tiktok in the US; as well as sending a cabinet member to visit Taiwan to find out about the country’s successful response to COVID-19.

We could get the Treasury report on countries manipulating their currencies please see our preview here.

We have 3 Fed speakers, all from regional banks rather than the Board and they seem unlikely to give us new information on the FOMC economic views or review of policy and procedures.

Links to New York Fed POMOs/TOMOs: Repos, Treasury, MBS, CMBS

G20

China is likely to figure prominently in G20 news this week as we are getting price, credit, IP, retail sales, investment and home price data. Consensus expectations are for continued recovery, especially in retail sales where recent data weaknesses have been inconsistent with the strong recovery of production data. There is also a RBNZ meeting where it could decide to expand QE.

Links to BOJ Rinban , BOE OMO

US States COVID-19 Monitoring

Dominique Dwor-Frecaut is a macro strategist based in Southern California. She has worked on EM and DMs at hedge funds, on the sell side, the NY Fed , the IMF and the World Bank. She publishes the blog Macro Sis that discusses the drivers of macro returns.

(The commentary contained in the above article does not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.)