A Brief Background to Chips

- Semiconductor shortages have been big news since the pandemic. No single factor explains them. COVID was clearly an exacerbating factor, but the issue has been around for much longer.

- Shortages lie predominantly in the more ‘mature’ (older generation) chip types, where investment spend is smaller and there is less incentive to increase production.

- For this reason, the problem will likely persist for a prolonged period.

What Is a Semiconductor? Why Are They Useful?

A semiconductor is a substance with an electrical resistivity between the very low levels of conductors and very high levels of insulators. We can change semiconductor resistivity by introducing impurities (doping). The most used semiconductor (due to its abundance) is silicon.

Depending on the type of impurities added, the doped silicon takes on a different directional charge. N-type, using arsenic or phosphorus as dopant, has a negative charge. Meanwhile, p-type, using boron or gallium as dopant, has a positive charge. Fusing these two types produces a diode. By applying an electrical field, we can turn this into an insulator or conductor at will (more information here).

This binary capacity makes them exceptionally useful in the production of integrated circuits (ICs), and today they are found in almost all electronic devices.

How Are Semiconductors Made?

Producing a silicon chip involves:

- Refining sand into silicon.

- Purifying, melting, and cooling the silicon into a cylindrical crystal.

- Slicing the silicon into very thin wafers (circular cross-sections).

- Building a grid of rectangular/square chips onto the wafers.

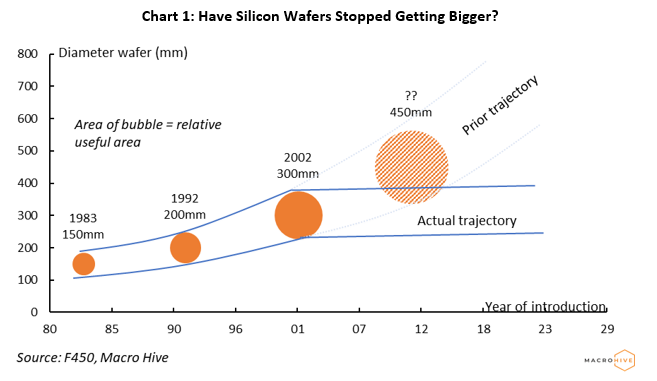

Production technology has improved significantly over time. The diameter of wafers has increased substantially since first appearing (increasing the surface area usable for chip production). Meanwhile, transistors on the chip (the so-called ‘node’) have become denser.

Difficulties in Semiconductor Production

Pre-1992, the largest commercially produced wafers were 150mm (6in), then 200mm (8in), then in 2002 came 300mm (12in). However, new logistical complexities emerge as wafer size rises. For one, the crystal becomes increasingly heavy and therefore difficult to safely manoeuvre. Further, the time required to cool the silicon crystal increases proportionally to volume.

For this reason, while much has been touted about potential 450mm wafers, the economics of the project have proven difficult. The first industry standards for 450mm wafers were agreed in 2008. Yet as of 2022, whether they will ever be put into commercial production remains unclear (Chart 1).

The exponential gains in production scale from the move from 150mm to 200mm, and 200mm to 300mm, have been missing for some time. Instead, foundries have clustered in the 200mm and 300mm buckets.

The node of chips is also important. Node is usually a measure in nanometres denoting the feature size (and hence density). The actual number no longer refers to the distance of anything specific. Yet as a rule of thumb, the smaller the number, the greater the density of transistors and the more complex the process to produce. For instance, a 5nm chip is cutting edge, while a 350nm is very mature tech. The node of the newest chips has reduced significantly.

The wafer size of a foundry and the node of the chips it produces are two separate measures. Yet we tend to define semiconductor fabrication plants (fabs) by their wafer diameters. Given the extra complexities of handling far larger silicon crystals, as a rule, a 300mm fab would be higher tech than a 200mm fab and would focus more heavily on the smaller node chips.

Demand for Semiconductors

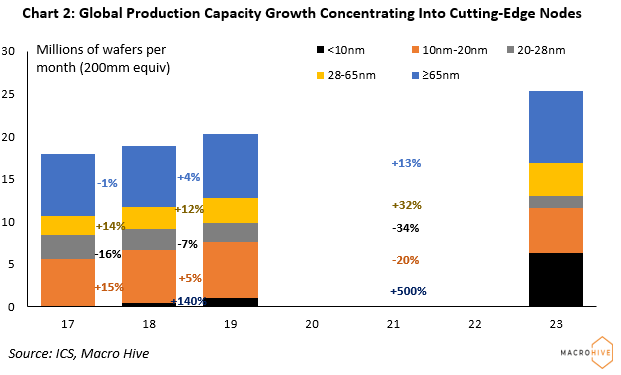

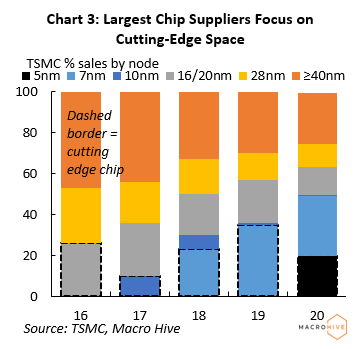

This is important as the investment in chip manufacturing, particularly among the largest players such as TSMC, continues to focus on the most cutting-edge spaces (Chart 2). That is because of the higher margins, potential IP advantages, and prestige of being the first to breach new technological hurdles.

For the largest chip suppliers, this concentration in the high-tech space is obvious from the breakdown of their sales revenues (Chart 3).

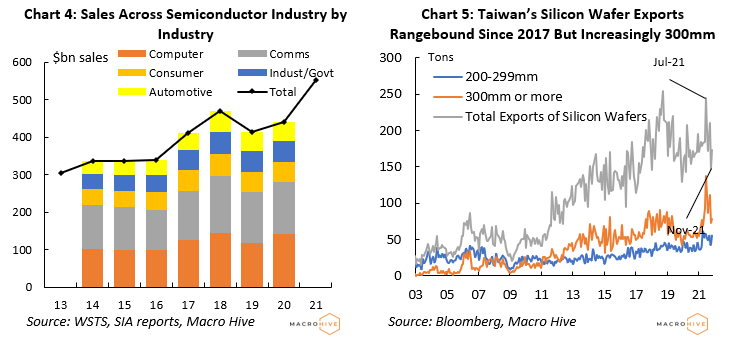

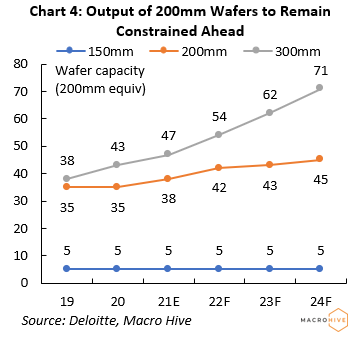

Semiconductor demand continues to rise in the cutting-edge space (smartphones and high-end computing). But since around 2015, in percentage terms, demand has risen even faster in automobiles and industry (Chart 4). The rise of the use of electronics in automobiles, the coming of the internet of things (IoT), and the adoption of 5G are all prime drivers of this new demand.

In these spaces, relatively older, less power-efficient, less size-constrained chips are necessary for systems such as displays, sensors, communications, and power-supply units (particularly important for hybrid and electric cars). Yet supply from the 200mm fabs, and therefore the less advanced chips, has been relatively constrained.

Taiwan’s Customs Administration Ministry shows the clear difference in supply patterns (Chart 5). 300mm wafer exports have risen rapidly, while 200mm ones have grown much more slowly.

For reference, Table 1 (compiled from TSMC’s 2020 annual report) shows exactly where the demand for the different nodes is across industries (note: as TSMC is cutting edge, it omits even larger chip sizes; carmaker MCUs can be made with chip processes from 28-160nm).

Table 1: Node Usage in Different Industries

| Industry | Purposes | Nodes Used (in terms of nm) |

| Smartphones | Low power IC, system on chip | 5nm, 6nm, 7nm |

| High-Performance Computing | CPUs, GPUs, NPUs, AI accelerators & related ASICs | 5nm, 6nm, 7nm, 12nm, 16nm |

| Internet of Things* | Lower power-consuming controllers, connectivity ICs and sensors | 12nm, 22nm, 28nm, 40nm, 55nm |

| Automobiles | Advanced driver assistance systems (ADAS), infotainment systems requiring processors, sensors, analogue (i.e. regulating temperature, speed, sound, current) and power ICs | 16nm, 7nm and 5nm for ADAS and infotainment 28nm, 22nm and 16nm for sensors & power management |

| Consumer electronics | Displays, AI functions such as picture quality improvement & voice control | 7nm, 16nm, 12nm, 22nm, 28nm variations |

* Bluetooth earphones, smart wearables etc. Bold = chips >16nm, i.e., the more mature processes

Source: TSMC 2020 Annual Report, Macro Hive

How COVID Affected Semiconductor Supply and Demand

When COVID struck in 2020, the push to working from home boosted demand for electronics, and lockdowns curtailed the supply from many chip fabs. Furthermore, many trends that had driven previous mature-chip demand accelerated, such as car electrification and the interconnectedness of appliances. This created a semiconductor shortage around the world.

Reports often suggest COVID hit automotive original equipment manufacturers (OEMs) particularly hard. They argue that when auto sales crashed in 2020, many OEMs stopped buying chips, and when it bounced back, many did not meaningfully increase their semiconductor orders (being unsure of the sustainability of the recovery). However, other evidence suggests that the total deliveries to the section continued to grow strongly through 2020-21.

In reality, it appears low spare capacity within more mature chip production is a long-standing issue. The COVID crisis, and the surge in new demand, has simply brought this to a head dramatically.

How Long Will the Semiconductor Shortage Last?

Problematically, no quick fix to the chip shortages exist. Industry insiders report that 300mm fabs are on track to meet demand by the middle of 2022. But 200mm fabs remain far behind, with a shortage of 200mm equipment further slowing the expansion of 200mm capacity.

Stories have emerged of 300mm fabs switching processing towards older product ranges and of 200mm fabs investing in expanded production lines, but these are relatively modest approaches, and will take a long time to bear fruit (Chart 4).

Instead, what lies ahead will be a prolonged period of semiconductor chip shortage in more mature products.

Chip Shortage Update

In August 2022, tech companies Intel, Nvidia, and Micron Technology all gave forecasts in their earnings reports that chip supply is outrunning demand. That would be good news for consumers, but worrying news for the companies as a supply glut could be coming.

However, the news of a buildup of unused stockpiles of chips is primarily limited to the PC industry. Now people are returning to offices, they no longer need additional home computing equipment. This reduces demand for products by producers in that industry.

Recently, chipmaker Micron Technology said its customers are still dealing with excess inventory of its products. It forecast depressed sales for at least the next two quarters. That bodes poorly for consumer electronics companies in the coming earning season.

Car Chip Shortage

A key source of demand for semiconductor chips is the auto sector. Over the past year, monthly auto sales have been around 13 million (annualized rate), versus a normal rate near 17 million (Chart 4). They could surely sell that volume if they could get the chips they need. Instead, that demand has been met by used cars – where prices are some 60% above pre-pandemic levels. Carmakers including Ford and General Motors have been painting a dim outlook through the third quarter due to the semiconductor shortage, which is hindering production.

Now, shipping issues are hampering supply lines as well.

FAQ

When will the chip shortage end?

Research from J.P. Morgan says that the chip shortage will probably end in the second half of 2022, but only for certain industries. For example, Intel CEO pat Gelsinger expects the semiconductor shortage to last until 2024 due to a lack of manufacturing equipment.

When will semiconductor stock recover?

Stocks associated with the consumer goods part of the semiconductor industry, such as Nvidia and Dell, will likely recover only after current headwinds subside and as they work off excess inventory. Meanwhile, companies that focus on semiconductors for industry and corporate IT departments generally report strong earnings and outlooks – most recently Broadcom (AVGO), which said its backlog is nearly a year.

Why is there a chip shortage?

Because the pandemic increased demand from consumers who were forced to work from home, and lockdowns limited production capacity. Longer-standing issues also contribute to the semiconductor shortage, such as a lack of investment in older types of chips on which industries still rely heavily.

This article first appeared in February 2022. It was last updated on 1 September 2022.