Summary

-

- February CPI showed no incremental progress on disinflation.

-

- As in January, core inflation remained elevated across the three major categories of shelter and non-shelter services, and goods except for used car prices that continued to fall.

This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

Summary

- February CPI showed no incremental progress on disinflation.

- As in January, core inflation remained elevated across the three major categories of shelter and non-shelter services, and goods except for used car prices that continued to fall.

Market Implications

- I agree with markets pricing a 75% risk of a 25bp hike at the March 22 FOMC meeting.

Core CPI Above Expectations

February core CPI MoM was 0.5%, above expectations of 0.4%, and headline was in line at 0.4% (Table 1).

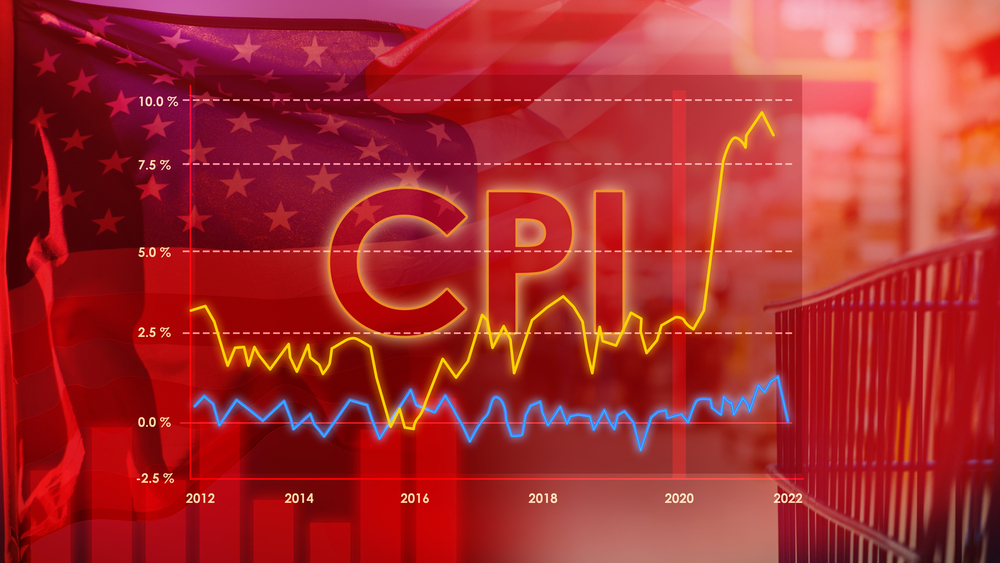

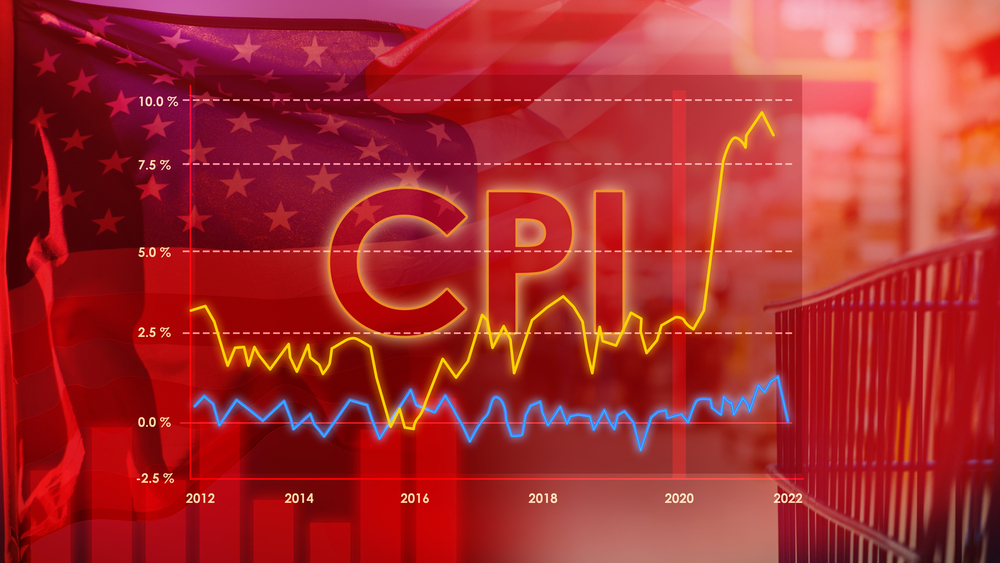

The YoY median price CPI, which is a better measure of inflation trends than core when all prices are volatile, accelerated (Chart 1).

In terms of inflation components, MoM shelter inflation was roughly unchanged, and a small decline in core goods inflation was offset by a small increase in core services inflation ex shelter.

Core Goods Prices Unchanged MoM

February core goods inflation was 0.01% against 0.07% in January. As in January, used car deflation offset robust inflation in core goods excluding used cars (Chart 2).

Historically, used car prices have followed the Manheim used car auction result. A recent recovery in the latter suggests used car deflation is likely to end soon (Chart 3).

No letdown in Shelter inflation

February shelter inflation at 76bp MoM was almost unchanged from January’s 74bp. At the same time, Zillow and apartment list rental cost indices rose in February, though this reflected in part seasonality (Chart 4).

Services Inflation Ex Shelter Accelerated

February core services ex shelter inflation was 36bp MoM, up from 29bp in January. Medical services deflation was offset by transportation inflation (Chart 5). Medical services deflation in part reflected a 4.1% MoM decrease in medical insurance costs, which itself reflects accounting conventions.

Limited Responsiveness of Core Inflation to Lower Energy Prices

When inflation is high, energy and core inflation become correlated. This likely reflects the higher correlation across price categories typical of a high inflation regime (see the BIS study: Inflation: a look under the hood).

The energy CPI was down 0.5% MoM in February, yet neither transportation services nor core goods, the more energy-intensive components of the CPI, moderated. Transportation and core goods have been much more responsive to rising than falling energy prices (Chart 6).

This suggests a lack of competition in the goods and services sectors and margin behaviors that could make it difficult for the Fed to curb inflation without a recession.

Market Consequences

Had the SVB bankruptcy not happened, today’s CPI and Chair Jerome Powell’s recent comments would have led me to call for a 50bp increase at the March 22 FOMC meeting.

After the SVB bankruptcy, however, the Fed could slow the pace of hiking until markets have fully normalized and confidence has been fully re-established. As a result. I roughly agree with market pricing of a 75% chance of a 25bp hike next week.

Should market turmoil resume, however, the Fed is likely to stay on hold on 22 March.