Almost no one is looking for a US recession in 2022. Economists’ consensus assigns only a 15% probability. Yet quarterly growth is expected to start 2022 at 4.5% (annualised) and fall every quarter to 2.6% by end-2022. Clearly, most expect US growth to lose momentum. So why not expect a US recession?

This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

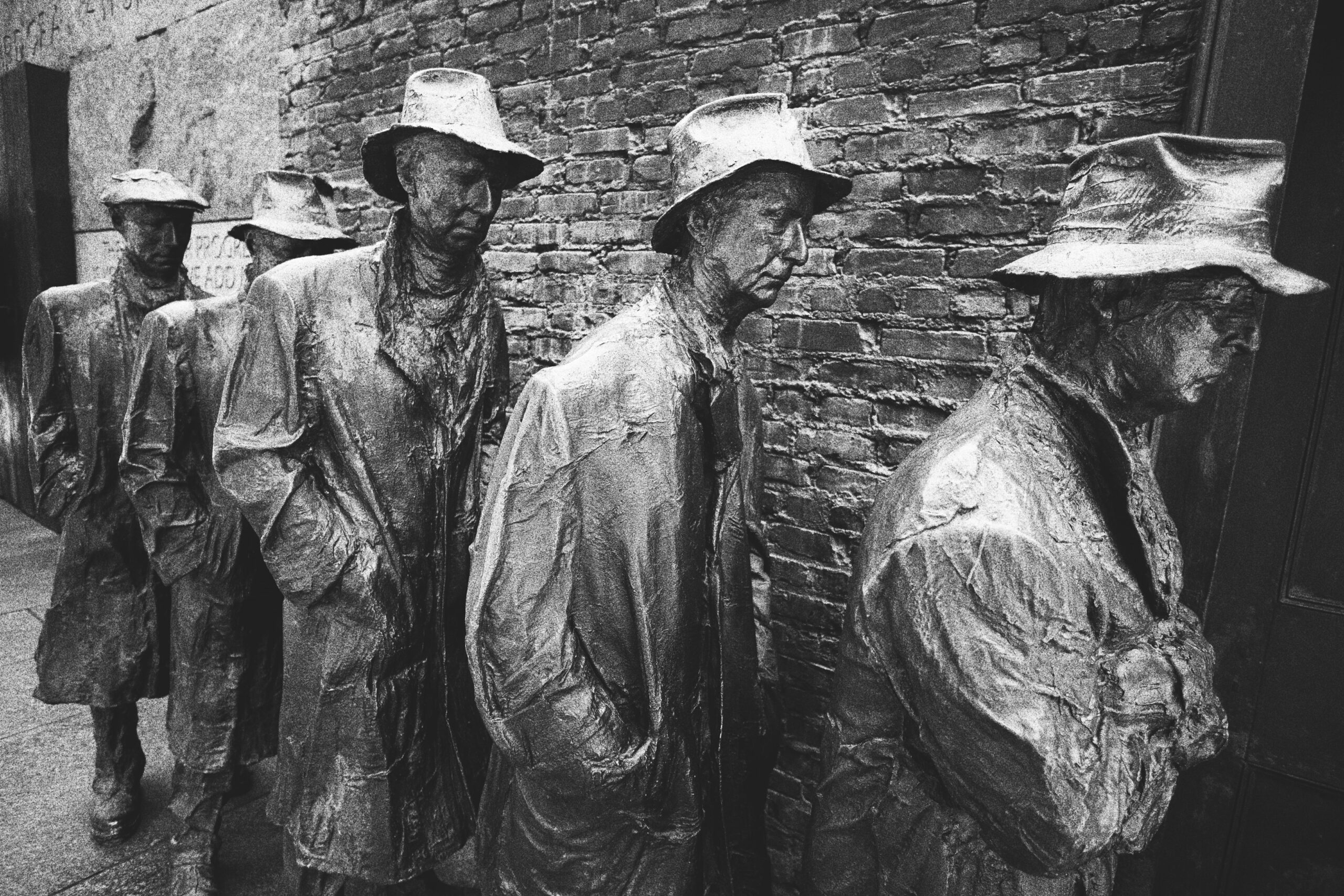

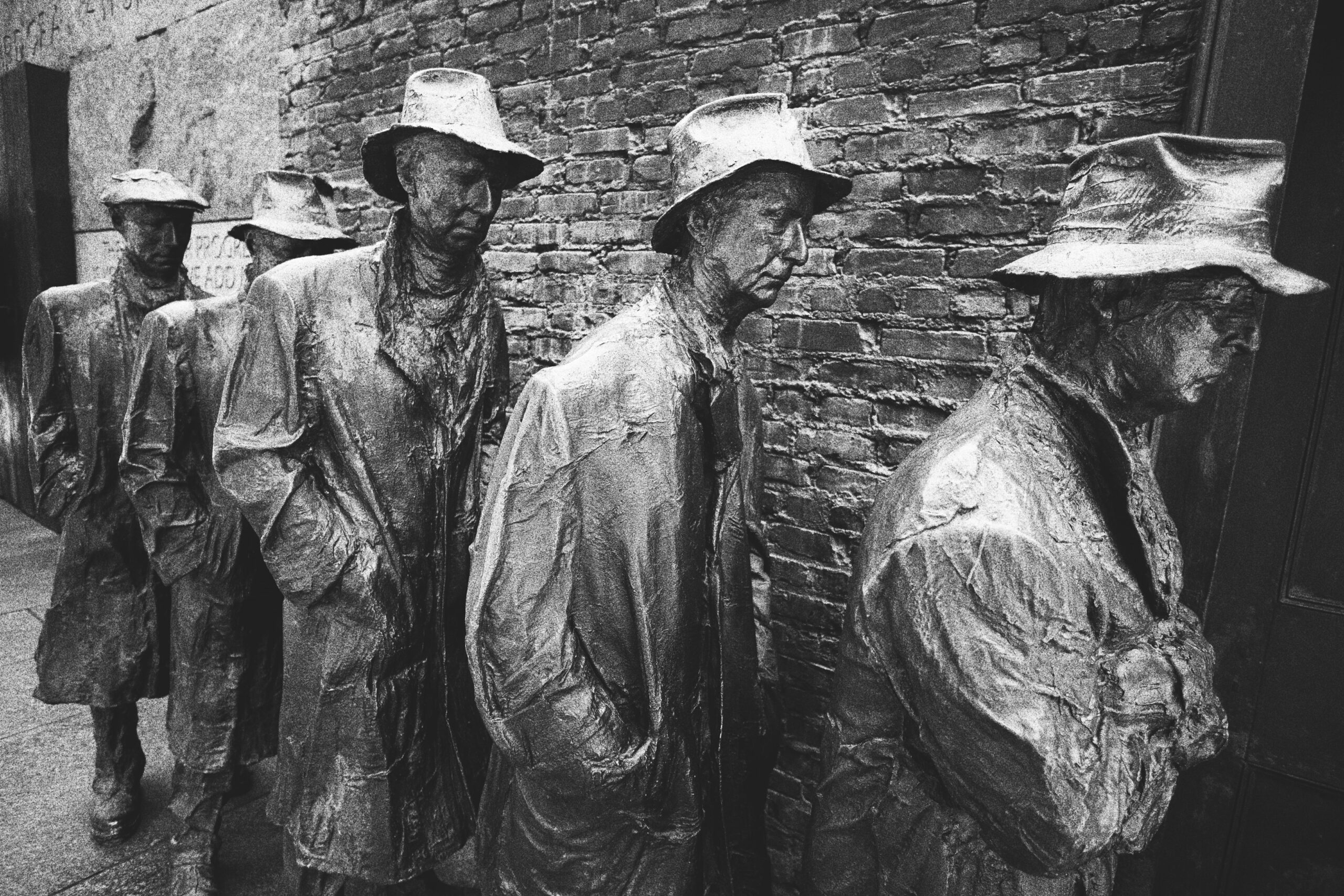

Grey Swans are those low-probability, high-impact events that few expect, and 2021 has felt full of them. We therefore continue our tradition of picking Grey Swans for the upcoming year. If you’re new to this tradition of ours, then please click here to learn more.

Almost no one is looking for a US recession in 2022. Economists’ consensus assigns only a 15% probability. Yet quarterly growth is expected to start 2022 at 4.5% (annualised) and fall every quarter to 2.6% by end-2022. Clearly, most expect US growth to lose momentum. So why not expect a US recession?

Indeed, the best recession predictors suggest one is possible in 2022. Fed rate hiking cycles have preceded almost all US recessions since the 1970s (Chart 1). And the Fed has swung from being dovish to primed to hike at least twice in 2022. This comes even as the US will see a negative fiscal impulse for the year because President Joe Biden’s latest fiscal packages will inject much less stimulus into the economy than in 2021.

The other reliable predictor of US recessions is oil prices. For all the talk of supply chain issues, we can simplify the current macro picture into one of an energy shock. Oil prices have risen over 80% in the past year, almost comparable to the 1970s shocks. Back then, the US economy tipped into a recession. Almost every time since, oil price surges have coincided with or shortly preceded recessions (Chart 2).

We can throw several other factors into the mix. The Omicron variant of COVID is looming, the Chinese economy has slowed sharply, and European growth is spluttering. That is a poor backdrop for growth in 2022. Accordingly, recession rather than inflation could become the theme of 2022.

Bilal Hafeez is the CEO and Editor of Macro Hive. He spent over twenty years doing research at big banks – JPMorgan, Deutsche Bank, and Nomura, where he had various “Global Head” roles and did FX, rates and cross-markets research.

(The commentary contained in the above article does not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.)