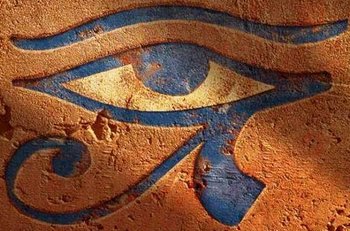

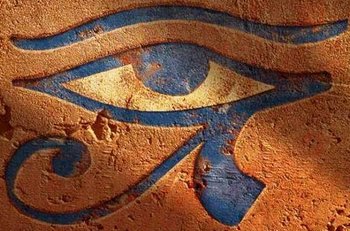

The Eye of Horus was a symbol used to protect pharaoh in the afterlife and to ward off evil. Exchange ‘afterlife’ with ‘future’, and ‘evil’ with ‘losses’, and implied volatility becomes the trader’s very own Eye of Horus.

I usually start my lectures on volatility with a glance at historic volatility. For a good reason. By assessing historic data, we can see how a certain security behaved in the past and from its performance make informed assumptions about future behaviour.

If we’re well-versed in the dark arts of quantitative analysis, we also have the opportunity to calculate certain probabilities based on that past behaviour.

What I never mention to my students – but implicitly take for granted – is the understanding that there can, unlike in politics, only be one past. A certain security moved the way it did. There’s no questioning the how, only the why. It is also true that a certain security can only follow one path into the future.

This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

The Eye of Horus was a symbol used to protect pharaoh in the afterlife and to ward off evil. Exchange ‘afterlife’ with ‘future’, and ‘evil’ with ‘losses’, and implied volatility becomes the trader’s very own Eye of Horus.

I usually start my lectures on volatility with a glance at historic volatility. For a good reason. By assessing historic data, we can see how a certain security behaved in the past and from its performance make informed assumptions about future behaviour.

If we’re well-versed in the dark arts of quantitative analysis, we also have the opportunity to calculate certain probabilities based on that past behaviour.

What I never mention to my students – but implicitly take for granted – is the understanding that there can, unlike in politics, only be one past. A certain security moved the way it did. There’s no questioning the how, only the why. It is also true that a certain security can only follow one path into the future.

The Confusion Begins, However, When We Talk About a Multitude of Implied Volatilities

Schrödinger says the future holds an infinite amount of possibilities and until you observe one of them, they are all possible, if not all equally probable. His rather cruel example was a cat in a box. The cat was trapped in there alongside a contraption with a 50-50 chance of activating and killing it, meaning that the cat had a chance of being dead or alive at some point in the future. Until the damn thing is opened, however, Schrödinger argued that it is dead and alive at the same time. Try to disprove this and a Nobel prize is waiting for you. Only once the box is opened can we know for sure.

Implied volatility reflects the state of the market just before we open the box. Pretty much anything is possible, but not equally likely. Our friendly next-door physicist would phrase it this way: ‘the probability density function has collapsed once the observation has been made’. In our terminology this translates into the following. ‘Implied volatility, an educated guess, becomes realized volatility, a dead certainty’.

You See Where I’m Going with This

The past is as sure a thing as the future is, after the future has happened. The here and now is the difficult bit. Of course, we can make predictions about the future health of our friendly feline if we have an idea of the death trigger mechanisms within the box, but we are never quite sure.

Now, if there are a bunch of physicists assembled in front of the box, they might all have different assumptions about the mechanism inside the box. Is it a skewed experiment giving the cat, let’s call it Garfield, better, worse, or even survival odds because of these assumptions? And how much would they bet on each outcome? Of consideration for the result might be the length of the term the poor animal has to spend in the box. Do its chances to make it out alive increase if it managed the first 15 minutes alive? Or are the odds never in its favour?

It’s a bit like insurance math. It’s more likely that you make 31 if you are already 30 at present, than it was, say, 5 minutes after you were born. By the backdoor (there is unfortunately not one in the experiment) I have introduced skew and term structure to you. Two expressions used by derivatives traders to describe how the odds (volatility) for a certain outcome are shifting, taking more variables (expiration time and strike levels), into consideration. Implied volatility, which can and most often is different, in the individual assessment of investors, tells us what the marketplace thinks about the future odds of an experiment. Or – applied to the case we are interested in – the likelihood to observe certain future prices.

It gets better. As option traders place bets with real money, their forecasts can be taken far more seriously than those of a group of physicists without skin in the game. As real tradable prices for options are observable in the marketplace, it is easy to extract the implicit odds allocated by traders for those different assessments about the future performance of a security. All the other ingredients used in valuation models are right in front of us. Spot price of the underlying security, risk free rate, maturity and strike price of the contract are given through simple observation. By throwing all ingredients into a valuation model – Black Scholes or whatever you prefer – there is only one variable left and for this we can solve. The resulting local volatility, or the assumed odds for every potential future price of a security is indicated to us by the amount of money an investor is willing to pay in relation to the odds he or she expects.

Eventually we will have to open the box (observe a future price) and know which expectation was the correct one. The guesswork we will have done based on past knowledge (historic- volatility) to arrive at a price we are willing to pay (implied volatility) will have become the past again (realized volatility).

Horus lost his left eye to Seth -the God of chaos- fighting for the throne. If the remaining eye allows us to see implied volatility would the right eye have given us the chance to maybe observe what’s in the box?