Asia | China | Emerging Markets | Politics & Geopolitics

Asia | China | Emerging Markets | Politics & Geopolitics

This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

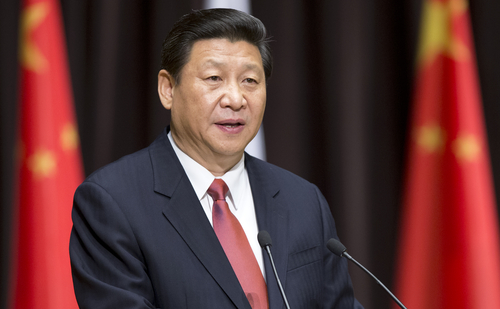

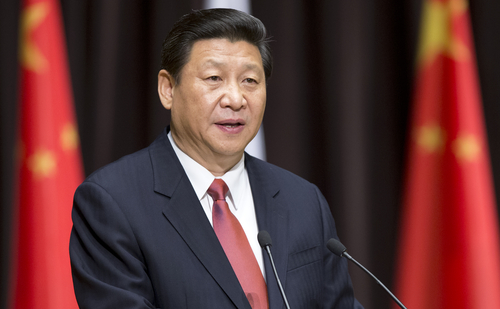

As the Party Congress approaches, the rumour mill of China politics is picking up. In this China Monitor, we consider possible personnel decisions and policy outcomes from the Congress. We also briefly look at the state of the Chinese financial markets in September.

A main purpose of the Party Congress is to decide leadership posts for the next five years. Members of the Standing Committee and Politburo will likely catch the most attention.

The questions being debated are:

In summary, the focus of the Party Congress will be on whether Xi emerges as an unassailable leader again, or whether he is ‘over his peak’ but still in command.

In terms of policies, we see the Party Congress as more about continuation and consolidation than change. Xi’s policy platform emphasizes ideology first and foremost. The Congress is likely to emphasize such topics as Xi’s vision for ‘common prosperity’ or his signature zero-Covid policy rather than economic reform.

As such, financial market consensus is that the Party Congress will bring no market-boosting news. Policies that have plagued stock markets in past years, such as heavy-handed tech regulation and a crackdown on the property sector, are expected to continue.

In the immediate aftermath of the Congress, negative newsflow for Chinese markets may even increase. The frozen property sector may continue to generate negative headlines, such as increased bank NPLs or local government vehicles struggling to handle the debt load. Also, with Taiwan’s local elections due in November, we may see renewed geopolitical sabre-rattling between Beijing and Taipei.

Finally, if such market pessimism prevails after the Party Congress, CNY will likely keep falling. Recently, USD/CNH reached a new high of 7.25. The PBOC has intervened since then, and spot is now closer to 7.00 again. But USD/CNH could reach a new high of, say, 7.50 if the Party Congress proves a dud for markets.

Chinese markets traded mostly lower in the past few weeks. A few measures were announced to support the property sector, but they were not seen as structural solutions for the sector. In response, the stock and credit market registered a small bounce only, from low levels (Table 1). Meanwhile, PBOC had to intervene in the CNY market. USD/CNY had risen above its previous peak of 7.20, to reach 7.25, but the central bank sold dollars to keep the renminbi stable as the Party Congress approached. In sum, pessimism reigned supreme in Chinese markets in September.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.