Monetary Policy & Inflation | US

Monetary Policy & Inflation | US

This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

November core and headline CPI prints were in line with expectations, as Sam’s model had predicted (Table 1).

MoM core CPI was roughly unchanged from October, but this time an acceleration in goods price inflation offset a slowdown in services inflation (Table 2).

Core goods inflation accelerated to 31bp from 5bp in October (Table 3, Chart 1). Most of the acceleration came from higher used and new cars and trucks (‘cars’ thereafter) inflation. Used car prices are volatile and November’s increase is likely not starting a trend. By contrast, new car prices, which the BLS adjusts for quality, have been rising.

November shelter inflation slowed to 34bp MoM from 38bp in October. The slowdown in OER was more pronounced: to 23bp from 40bp in October (Chart 2).

In any event, market rent indices (aggregate rents paid by tenants moving to new units) that tend to lead OER remain stable (Chart 3). Jerome Powell has reiterated his confidence that, while housing inflation was the laggard in the disinflation process, it would eventually slow to levels consistent with the inflation target.

November supercore inflation was 34bp MoM and 4.3% YoY, respectively, up from 31bp and down from 4.4% in October (Chart 4).

Transportation and education and communications inflation slowed but lodging away from home inflation accelerated (Table 4).

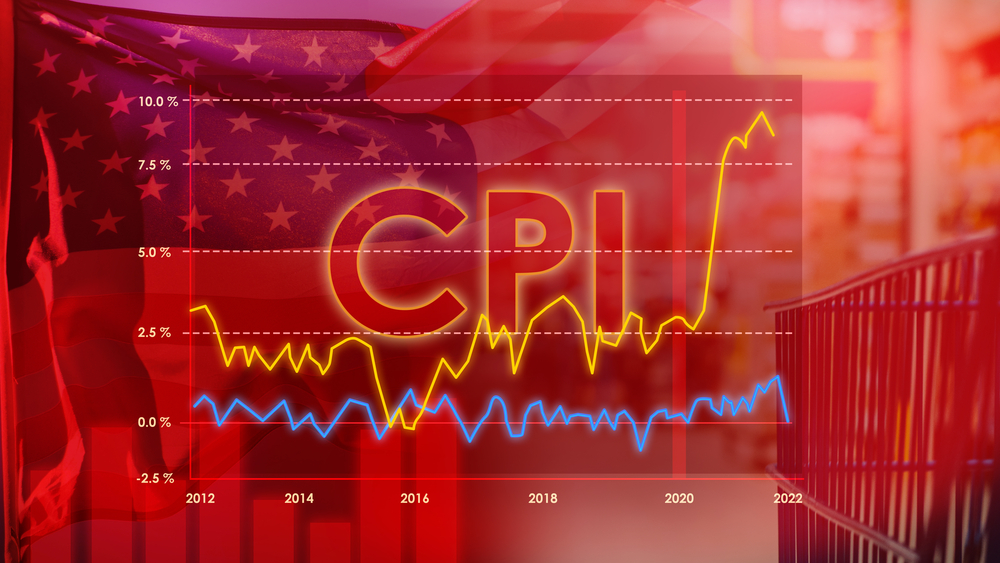

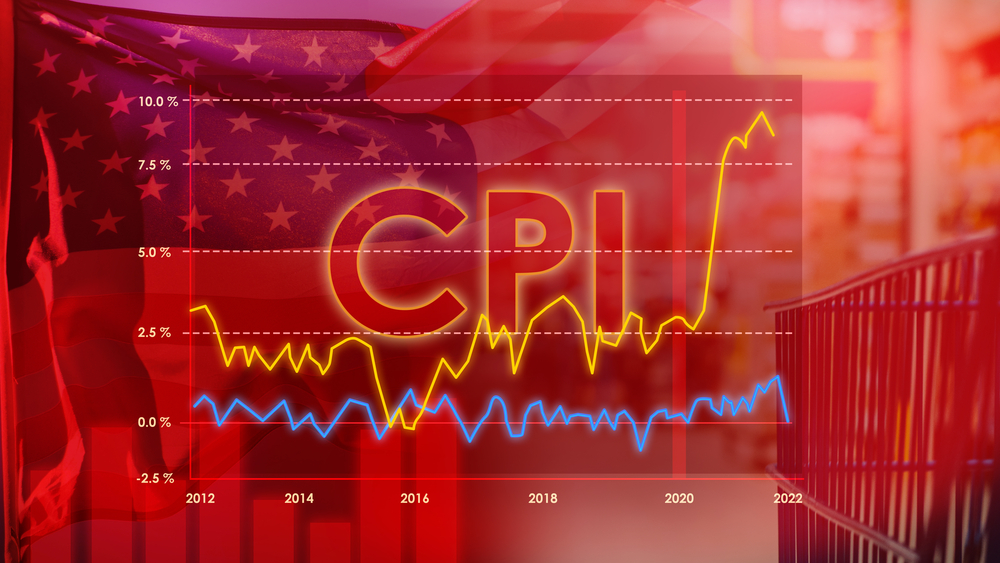

Overall, the inflation pattern remains of goods price deflation not large enough to offset services inflation that has started to stabilize well above target (Chart 5), In addition, goods price deflation has been easing.

On a YoY basis, measures of inflation trends such as trimmed mean and core inflation have stabilized while sticky price and median price inflation are still slowing (Chart 6).

Following yesterday’s CPI print, the Cleveland Fed updated its November core PCE nowcast to 27bp MoM or 2.9% YoY. This paves the way for a Fed cut next week. Markets currently price about 95% chance of a cut, which is in line with my conviction.

The longer term trend implied by yesterday’s release is also in line with my expectations of inflation remaining stuck above target next year, which will prevent the Fed from cutting. By contrast, markets are pricing two and a half 2025 cuts.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.