Monetary Policy & Inflation | US

Monetary Policy & Inflation | US

This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

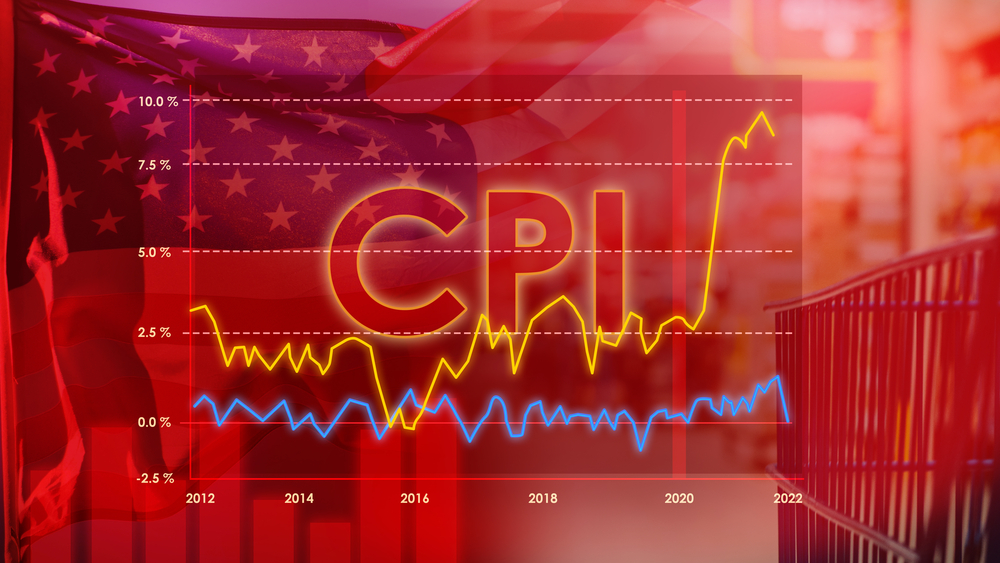

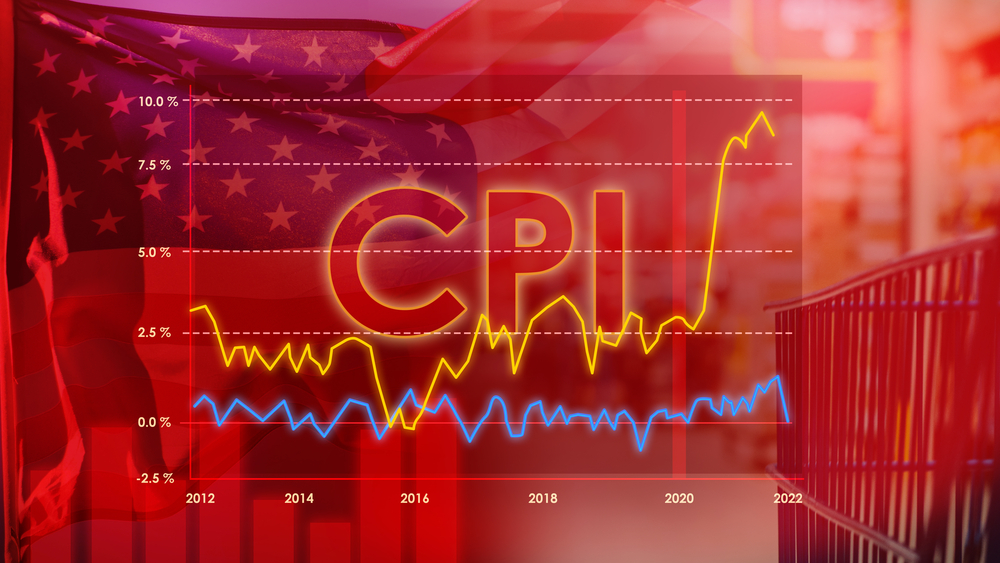

June CPI headline and core MoM inflation at -6bp and 6bp respectively were below market expectations. Sam’s model predicted the headline miss (Table 1).

The key change relative to May was a decline in OER (Table 2). Supercore inflation was roughly unchanged (i.e., negative).

Excluding used cars, core goods inflation remained negative (Table 3, Chart 2). Used car prices fell.

The most important change in the June CPI was the long-awaited start in housing disinflation. OER slowed to 28bp MoM from above 40bp in May-June.

That said, the Fed will need more than one data point to gain confidence shelter disinflation will continue. The Fed believes (and I agree) there is a US housing shortage. Current data and anecdotal evidence show the housing market remains hot. Market rents, which tend to lead CPI shelter costs, have bottomed out (Chart 3). Rental and owned home vacancies remain below pre-pandemic. A recently published Boston Fed note highlighted upside risks to shelter inflation in 2024.

Supercore inflation was -5bp, roughly unchanged from -4bp in May (Chart 4, Table 4). Medical services and lodging away inflation slowed while other personal services inflation accelerated. Lodging away from home’s 2% drop detracted about 5bp from supercore inflation. Higher haircuts and funeral expenses costs drove the swing in other personal services inflation from -32bp in May to 92bp in June.

Median price CPI, a better indicator of trend than core, slowed further to 19bp, from 25bp in May. On a 3m annualized basis, median price CPI inflation is now below the mid-2023 lows (Chart 5).

Yesterday’s median price CPI is consistent with the US economy remaining stuck in a high inflation regime, where energy and median price inflation are correlated. Energy inflation troughed at end 2022, which saw median price CPI and PCE inflation trough in mid-2023.

Since 2022, energy prices have been volatile, but the trend is gently up, suggesting limited further downside to core CPI.

Even after yesterday’s better data, the CPI is still far from the Fed’s 2% target (Chart 6). Because of the US housing shortage, shelter inflation is likely to remain above the Fed’s target, which must be offset by slower goods and supercore inflation.

The US economy has further to go to reach 2% inflation sustainably. The SEP shows inflation returning to target only in 2026.

At this week’s testimonies to Congress, Fed Chair Jerome Powell stated he now sees risks to the inflation and employment sides of the mandate as balanced. He also refused to provide guidance on when the first cut could occur.

June CPI increases the Fed’s confidence in disinflation and risk of a 2024 insurance cut. However, most of the FOMC is likely to agree with St Louis Fed president Musalem, who said yesterday that even after the June CPI he will need more good inflation data before he is comfortable with cutting.

I expect this is mainly because the fast disinflation of H22023 was followed by a quarter of sticky inflation. The Fed does not have an inflation framework but rather is data driven. As the data has been volatile, the Fed is likely to require an extended period of disinflation to feel confident enough to cut.

For instance, as mentioned above, we only have one month of OER disinflation. Furthermore, the Fed targets PCE rather than CPI. Preliminary indications are supercore PCE could be more elevated than core CPI, but we need today’s PPI to have a more precise idea of where PCE will print.

The broader macro context, especially labour market data, will drive how much more good inflation data the Fed requires to cut. Recent labour market data has been mixed. Unemployment has been rising, but NFPs remain above pre-pandemic levels. Signs of labour market weakening (e.g., NFPs below pre-pandemic average) would bring forward an insurance cut.

However, as long as the economy is in good shape, politics suggests any cut would likely happen after the 5 November election (i.e., at the 7 November or 18 December FOMC). This is because the election outcome could materially impact inflation risks. Also, the Fed will be very attuned to perceptions of political bias. Should Trump win, it will need Republican support to maintain its independence.

My conviction on no cut in 2024 is weaker after the June CPI. On the other hand, I do not see the Fed cutting more than once in 2024, and I disagree with markets pricing 2.5 cuts by December 2024. We trade this view through a tactical short in the Jan 2025 Fed funds.

.

.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.