US

Key Points:

- Chair Powell started to discuss normalization strategies this week and a H2 2021 announcement of a 2022 taper now seems likely.

- US confirmed COVID cases are rising but seem unlikely to derail the recovery as hospitalizations are not increasing much while immunizations are continuing apace.

Fed

This week we got more info on the Fed normalization strategy and its LT framework. Chair Powell proved more willing to discuss normalization strategies than at the March FOMC meeting. He indicated that the Fed might decide not to let bonds roll off the balance sheet and repeated that taper would take place well ahead of lift-off. He further indicated that he saw the economy at an inflexion point, and that the main source of downside risk was if vaccines could not cope with the new COVID variants.

When you add this week’s comments to the March 17th comment that “we will want to provide as much advance notice of any potential taper as possible. So when we see actual data coming in that suggests that we’re on track to perhaps achieve substantial further progress, then we’ll say so” and to last week’s comments “We want to see a string of months like March NFPs so we can really begin to show progress toward our goals”, they suggest that a 2022 taper could be announced in 2021 H2.

By the Sep 2021 FOMC meeting most of the US population will be immunized and it will be clear that the vaccines are protecting against the variants, my base case scenario. In addition, there will have been enough time for the economy to experience “a string” of one million or so NFPs, which could be enough signs of “substantial further progress” to announce a taper. A slower labour market recovery could see the taper announcement move to December.

Vice Chair Clarida explained that the new Fed framework is about re-anchoring expectations, my view for some time. He stressed the importance for monetary policy implementation of a new LT inflation expectations indicator developed by the Fed staff, the CIE (index of Common Inflation Expectations) updated quarterly on the Board site. “Other things being equal, my desired pace of policy normalization post liftoff to return inflation to 2 percent would be somewhat slower than otherwise if the CIE index at the time of liftoff is below the pre-ELB (effective lower bound) level.”

This new index is clearly at the core of the Fed’s new, outcome-based policy framework (as opposed to the previous framework based on expectations of unemployment and inflation). It serves to both measure success in re-anchoring expectations and to warn of risks of de-anchoring. In addition, Clarida made clear that the benchmark for the CIE is the level before the Fed funds hit the 0 bound, i.e., before 2008. While the CIE has recovered from its 2016 low, it remains well below its 2008 level.

There are no Fed speakers this week as the pre-meeting blackout started this weekend.

Data

The very large retail sales surprise together with the small CPI 10 bp upside surprise suggest the V-shaped, non-inflationary recovery I have been expecting is on. The Economic Policy Uncertainty Index, a proxy for households risk aversion is back to its pre-pandemic range (Chart 2), which suggests further declines in the household savings rate that, at 13.6% in February, remains well above the pre-pandemic range of 7 to 8%.

I do not expect the ongoing, moderate resurgence in cases to slow the recovery as hospitalizations are not increasing and immunization are continuing to increase by more than 3mn a day (Chart 1 and 4). Texas, that has been the fastest in re-opening its economy, has seen a marked increase in cases but with limited impact on hospitalizations (Chart 3). A San Francisco Fed paper suggests the limited increases in US cases reflects past infections and high collective immunity, which could explain Chair Powell’s sanguine view of the economy.

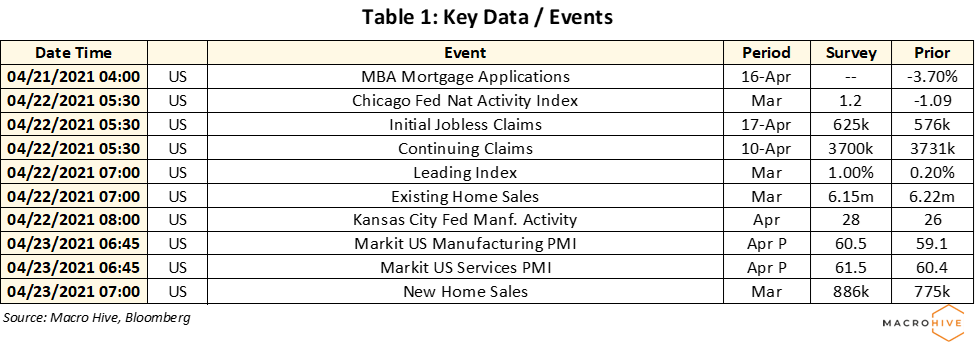

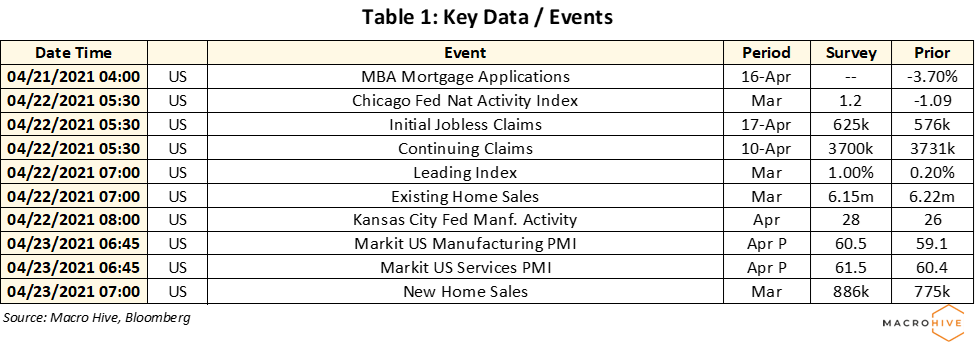

This week’s most important data will be the Markit PMIs, and the Bloomberg forecast survey seems reasonable to me.

Events/Political Developments

It is early days but both GOP and democrats are preparing the Nov 2022 mid-terms. Two developments this week highlighted the dilemmas faced by the GOP: energy and grass root fundraising are more with former President Trump supporters than with the party establishment but the policies supported by the former are unlikely to win the centrist votes the GOP needs to regain Congress.

The latest report from the Federal Election Commission on fund raising released this week showed that the 10 House Republicans who voted to impeach President Trump after the January 6 riots raised significantly more than their challengers backed by President Trump. Most of the contributions however consisted of large donations, by contrast with the small, grassroot level donations raised by President Trump supporters.

A group of House Republicans led by Rep. Marjorie Taylor Greene scrapped plans to establish a caucus praising America’s “Anglo-Saxon political traditions” as well as promoting “an infrastructure that reflects the architectural, engineering and aesthetic value that befits the progeny of European architecture”. The GOP leadership reacted strongly to the proposal, with minority leader McCarthy stating that “The Republican Party is the party of Lincoln & the party of more opportunity for all Americans—not nativist dog whistles.” Furthermore, former President George W Bush penned an editorial urging bi-partisanship on immigration policies.

Links to New York Fed POMOs/TOMOs: Repos, Treasury, MBS, CMBS

Links to New York Fed POMOs/TOMOs: Repos, Treasury, MBS, CMBS

G20

This week the ECB and the BoC hold their policy meetings and the RBA publishes the minutes of its April meeting. Central banks speakers include the BoE’s Ramsden and Bailey and the ECB’s Cipollone.

Key data this week include PMIs in Australia, Japan, France, Germany, the UK and the euro area as well as CPI in the UK, Japan, and Canada.

Links to BOJ Rinban , BOE OMO

Links to BOJ Rinban , BOE OMO

COVID-19 Monitoring