A put option is a contract that grants the owner the right, but not the obligation, to sell a certain amount of the underlying security at a predetermined price during a specified time frame. This price at which the owner of the put option can sell the underlying security is referred to as the strike price. Put options are also commonly referred to as just a “put”.

Trading put options grants the holder the power to sell various underlying assets – like stocks, currencies, bonds, commodities, futures, and indexes. It is the reverse of a call option, which grants the right to buy the underlying security at a set price.

Understanding put options can be a bit difficult. However, once you understand them, it is possible to use them to not only increase returns but also reduce risk while investing. Here, we give you a complete primer on what is a put option, how it works, and call vs. put option differences.

How Does a Put Option Work?

Owning a (vanilla) put option allows the buyer to sell a security at a specific strike (a determined price you can choose to exercise the option at) on/during a specificied window. The window will change depending on the type of put option you buy. The main two are:

- European put options: You can exercise your right to sell the underlying security only at maturity.

- American put options: You can exercise your right to sell the underlying security at any point before, and on, the day of maturity.

For example, imagine it is 1 January. You are the owner of a three-month European put option that is set to expire on 31 March. You can exercise your right to sell the underlying option at maturity (31 March). An owner of an American put option, however, could exercise their right at any time.

The price at which you sell the underlying asset is known as the strike price. For example, Company A currently trades at $100 and the described above put option has a strike price of $110. That means, on 31 March, you can sell 100 of Company A shares for $100 – typically, one option represents 100 units of the underlying asset.

But how much do you pay for the right to own this put option? We will get into that later, but this is known as the premium. That is, owning that three-month put option is not free, otherwise, everyone would own them! Therefore, the seller of the put option will charge a premium for you to own the option. This premium MUST be paid regardless of whether the buyer exercises the option.

Of course, it is possible for you to buy and sell the put option. Selling a put option simply reverses the roles in the transaction. Once you sell the option, you receive a premium, but the buyer has the right to exercise the contract.

How to Calculate the Option Intrinsic Value?

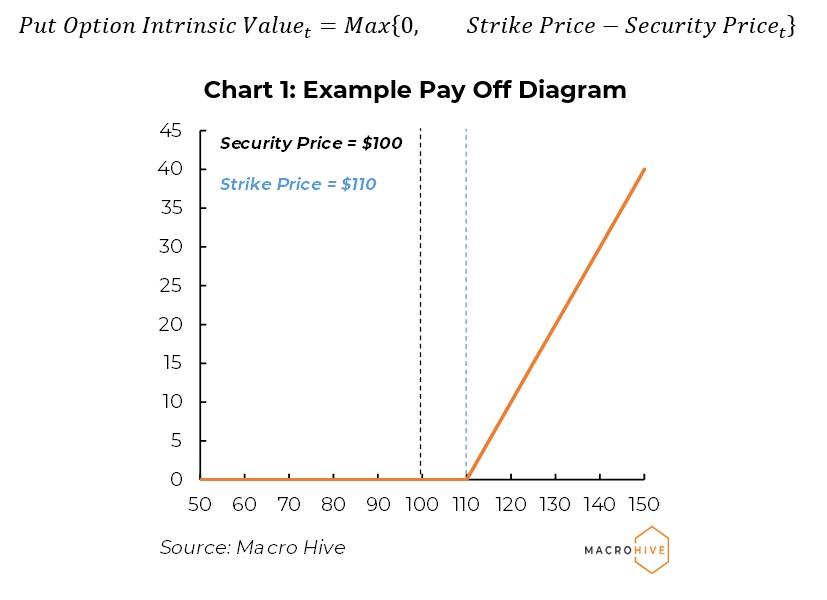

Put Option Intrinsic Value = Strike Price – Security Price

Let’s take a step back. We have just learned what the strike price is, when you can exercise an option, and that you can buy and sell them. But this is where options get a bit tricky. How do they make you money? Or, just as importantly, stop you from losing money?

To get there, first we must understand what makes up the price you pay for an option (it’s premium). We can define the premium as the following (we will get onto the widely used mathematical formula later):

Option Premium = Intrinsic Value + Time Value

Immediately, two new terms to learn! Starting with the intrinsic value:

Put Option Intrinsic Value = Strike Price – Security Price

Plugging our example (REMINDER: a three-month put option with security price = $100 and $110 strike) into our brand-new formula we find it has an intrinsic value of $10 (Put Option Intrinsic Value = $110 – $100 = $10). Great! It means our put option is in-the-money (ITM).

What if the security price rose to $120? We would have a negative [put option] intrinsic value ($120 – $100 = -$10). No fun: our put option is out-the-money (OTM)!

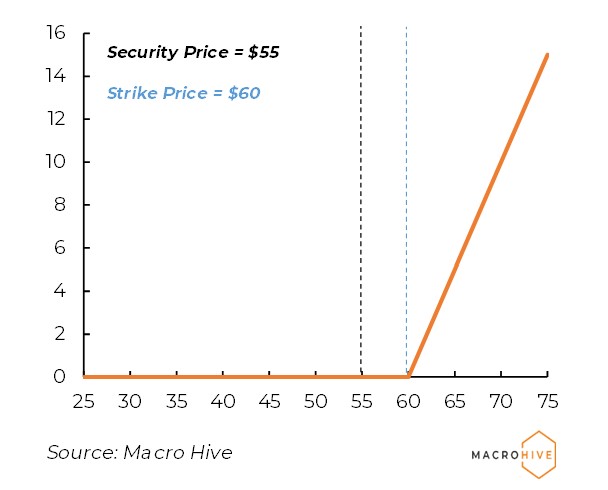

Of course, investors want to make money. Or, at the very least, not lose money. Thus, if a negative intrinsic value arises, they likely choose not to exercise the option (though they still can!). Therefore, we can define it as the following and can easily visualise our pay-off diagram (Chart 1).

Exercise:

An investor owns 100 shares of Stock XYZ, which is trading at $55. The investor is worried that their investment may depreciate, with Macro Hive thinking it could fall by $10 over the next month! The investor owns a put option that will mature in one month with a strike of $60.

- Draw the pay-off diagram.

- Calculate the intrinsic value.

- Is the investor holding an in-the-money (ITM) or out-the-money (OTM) put option?

Let’s Calculate the Profit of our Option!

At this stage, you might be screaming from the top of your lungs:

What is time value?

Time value is how much of your option premium you can attribute to time. In short, an investor will (typically) pay MORE for a put option that has longer to expiry because this improves the time available for the put option to expire ITM.

To calculate time value, we need to back it out of option premium. So, let’s dive headfirst into pricing a put option!

Pricing a European Put Option

There are many ways to price a put option. For European put options, a Binomial pricing model proves simplest while seminal work of Fischer Black, Myron Scholes and Robert C. Merton provides the most common model – the Black-Scholes(-Merton) model. There are a lot of factors that affect the price of a put option, which you can measure using Greeks. Here are some of the factors that will affect the price of the option:

- Implied Volatility (IV; σ): In the words of our very own Thorsten Wegener, IV is: “the future expectation of volatility or ‘how much stuff moves.’”

- Underlying Price (S) and Strike Price(K): If the current price of the underlying security is close to the strike price or ITM, then the price of the option will be higher. Conversely, the price would be lower if the option is currently OTM.

- Time Until Maturity (t): The longer the time of the put options contract, the higher the premium will be. This is because the seller of the option is exposed to the risk of loss for a longer period.

- Interest Rates (r): Just like almost any other investment, the prevailing interest rate influences the price of the put option. Usually, a rise in interest rates leads to a fall in the value of the put and vice versa.

- Payouts, e.g., Dividends (q): This mostly affects the premium of the option. If the stock is known for providing high cash dividends, it is expected that the price of the stock will fall after the dividend is paid. This leads to higher premiums for put options.

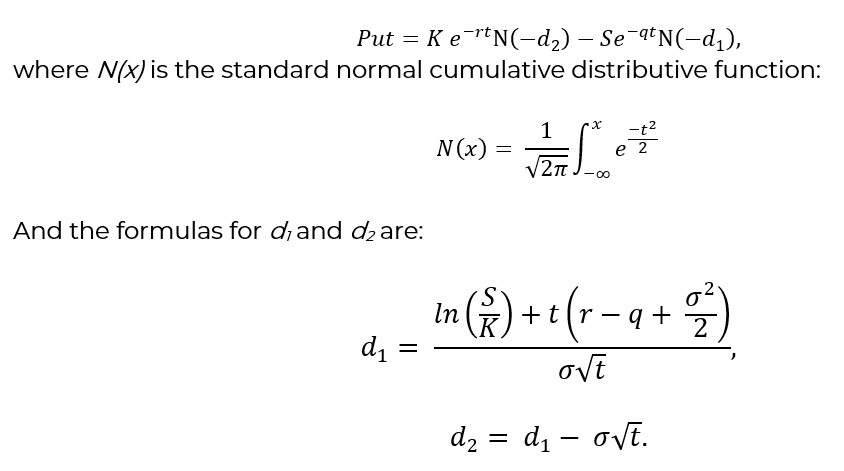

All these factors are then input into the option calculator. The calculator then uses an option pricing model to calculate the price of the put option. While there are more advanced models out there, the Black-Scholes model is the one that is most commonly used. It is defined as:

Remember that if all this seems a bit too complicated, Thorsten Wegener and Bilal Hafeez discuss the simplest way to understand option markets on Macro Hive Conversations. As Thorsten says about options, ‘If you break it down, what it really is, it is a way of measuring the value of something. And you try doing that by guessing the volatility, the future volatility.’

Put Options Vs. Call Options

The difference between a call and a put option is simply put (no pun intended): the two option types are the opposites of each other. With a call option, the buyer has the ability to purchase a specific quantity of a commodity or financial instrument (referred to as the underlying asset) from the seller of the option by a pre-determined date at a pre-specified price (the strike price).

Conversely, a put option grants its buyer the privilege of selling the underlying asset at an agreed-upon strike price before the expiry date.

It is possible to go long and short on both option types.

How and Where to Trade Put Options

When it comes to trading put options, you will need to make use of a brokerage. Remember that options are considered advanced instruments. As such, many brokerages do not allow users access to options trading by default. Instead, you will need to apply and confirm that you are willing to take on the extra risks associated with options trading.

There are a lot of brokerages that specialize in options trading. However, the additional features they offer are usually only useful for the advanced trader. As a novice options trader, any brokerage that allows you to trade options should suffice.

Remember that a standard put option contract is based on 100 units of the underlying security (e.g., it would be 100 shares if it was a stock).

Buying and Selling Puts: Strategies and Examples

Let’s look at buying a put option first.

The main reason to go long on a put option is when you believe the price is going to go down. Stock A is trading at $100, and you purchase an option with a strike price of $95 and 30 days until expiration. Assuming a volatility of 20% and an interest rate of 5% and no dividends, the price of a single option would be roughly $0.5 (therefore, the price of the contract is $0.5*100=$50).

Let’s assume the price falls to $90 before expiration, and you decide to exercise the option. Here, you purchase 100 shares of Stock A for $90 and sell them for $95, pocketing yourself $500. Once you subtract the premium, your total profit is $450.

However, if the price does not fall below $95 during the 30-day period, your loss is only the option premium ($50). Of course, the real world would also involve brokerage fees, but we are excluding those here for simplicity’s sake.

Now, if you had sold a stock A put option, the situation would reverse itself. You would receive a premium of $50 when you short the put option. Now, if the price were to fall to $90 and the buyer exercises the contract, you would end up losing $450 (total loss minus the premium). However, if the stock does not fall below the strike price, your profit will be $50.

Seller’s Risk

It should be obvious from the example above that the upside for the seller is limited. If the underlying security does not move into the strike price, the buyer will simply not exercise the put option. However, the theoretical downside is quite a bit larger as the security could fall under the strike price by quite a margin.

Buyer’s Risk

As we stated numerous times before, a put option is a zero-sum contract between the buyer and the seller. The downside for the buyer here is limited, and the upside is potentially much larger.

Writing a Put

For those new to the world of options, the put option writer is simply the trader who is short the put option (the seller).

We have already discussed how the buyer and the seller of the option take on opposite risks during the trade. The one thing to remember is that the put option writer is obligated to take delivery if the buyer exercises the contract. As such, the writer does not have any control over the contract once it has been written.

While this and the example above may make it seem like the buyer has an inherent advantage, that is not true. The put option calculator using the Black-Scholes model takes the implied volatility of the security into account and comes up with a premium that takes all the other minute details into its calculation too. As such, no party is actually at a disadvantage.

Summary

By now, you should have a basic understanding of put options, how they work, and how you can make money by purchasing and selling them. Just remember that options are quite risky and should be traded with caution.

It is also important to remember that options are not only traded directly to generate returns. There are a lot of alternatives uses for them as well, such as hedging other positions in the trader’s portfolio. Those looking to gain additional insights into volatility and options can listen to Adam Iqbal at Macro Hive Conversations.

FAQ

How to Exercise a Put Option?

If your put option is within the strike price, you can simply exercise the put option through your brokerage and the profits will be deposited into your account. Of course, you cannot exercise the option if you are the writer and must comply if the buyer decides to exercise it.

How Does a Put Option Work?

A put option works by giving the purchaser the option to buy a specific security at a specific price for up to a certain period. The purchaser pays a premium to enter the put option and does not necessarily have to exercise the contract.

Exercise Answers

- Draw the pay-off diagram.

- Calculate the intrinsic value.

Put Option Intrinsic Value = Max{0, $60 – $55},

= Max{0, $5},

= $5.

- Is the investor holding an in-the-money (ITM) or out-the-money (OTM) put option?

In-the-money.