Markets to Watch: Will a Dovish BoE Open the Way to Cuts?

Viresh Kanabar

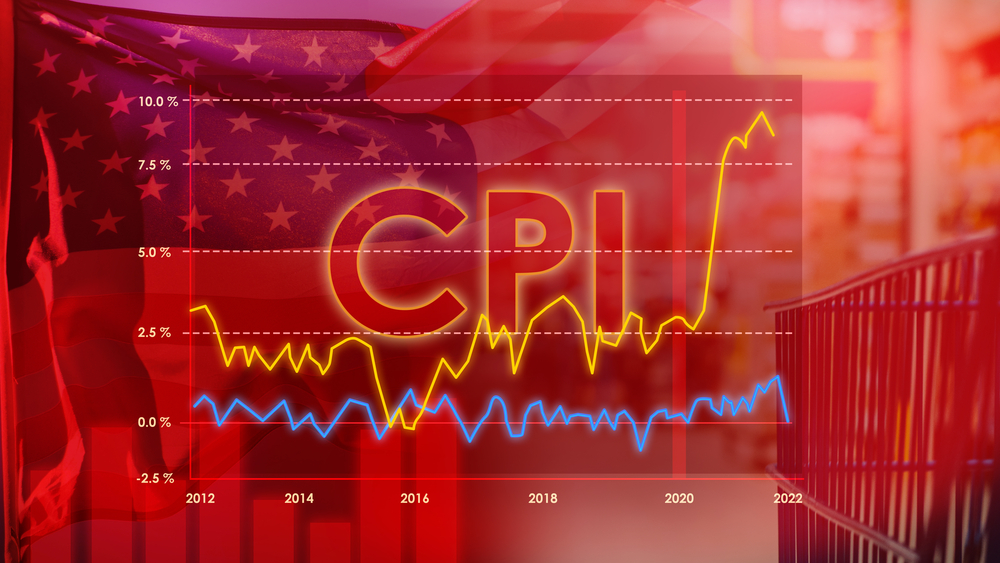

Key Events G10 In the US, our focus will be on the consumer confidence survey: Mich. Consumer confidence (Friday): Consensus expects no change. We agree based on inflation stickiness (the survey tends to reflect HH inflation perceptions). We expect little change in short- and long-term inflation expectations, with the latter stable but higher than pre-pandemic. […]