This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

Summary

- US core inflation will likely remain at 0.3% MoM. For retail sales, Dominique anticipates a small upside surprise to show the consumer remains resilient.

- Uncertainty surrounds UK inflation data out Tuesday thanks to reweighting factors. Henry expects core to undershoot BoE estimates.

- Australian NAB data could show a continued decline in price expectations, while RBNZ Governor Orr should guide us into the February rate decision.

- Indonesia’s election takes centre stage in EM. The latest polls indicate Prabowo/Gibran could win president/VP by a slim majority.

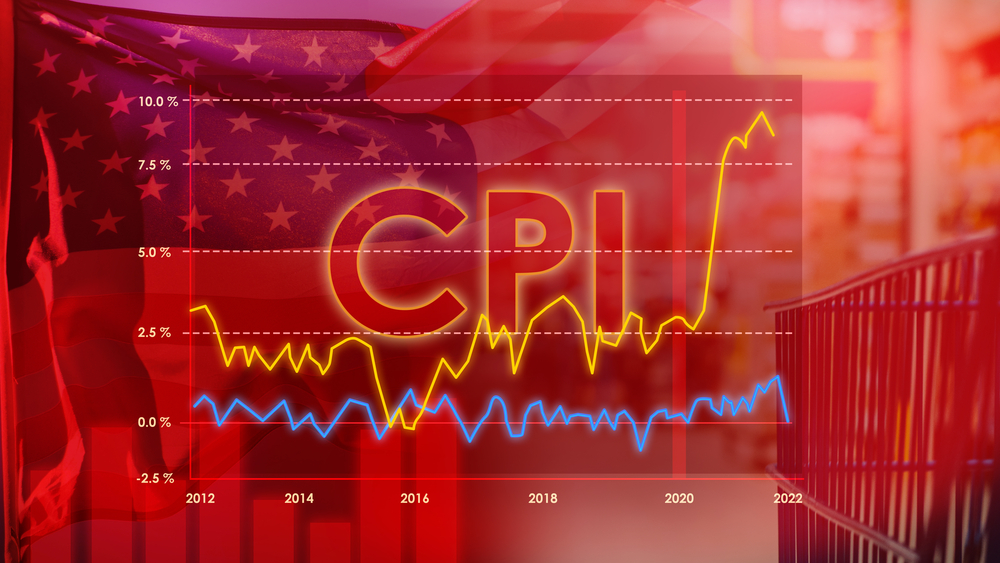

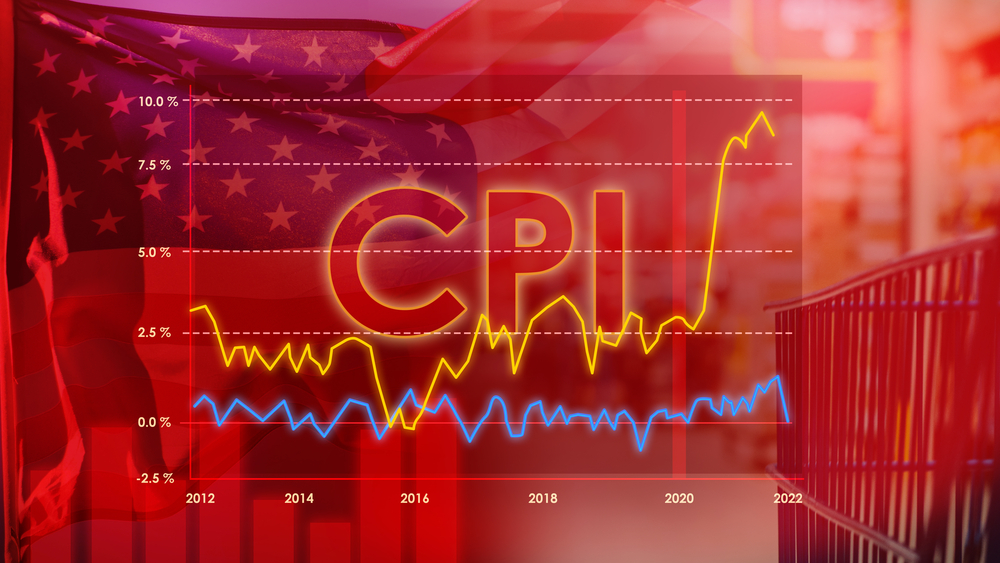

US: CPI, Consumer to Remain Robust

Last week, all 10 FOMC speakers stressed the Fed could be patient and would cut only once it felt confident inflation remained on a sustainable path to 2%. Dominique still thinks a March cut is unlikely – against markets pricing a 20% risk – with the Fed to watch for any hot MoM prints. This week we have:

- CPI (Tuesday): consensus seems reasonable. Dominique expects a slowdown in OER and for supercore to remain around 40bp. We could be entering a slower ‘last mile’ of the disinflation process.

- Retail sales (Thursday): a small positive surprise is possible since the consensus on control group growth implies a contraction in real terms. This seems too pessimistic given labour markets and income trends, even with last month’s large increase.

- U. Mich. consumer confidence (Friday): following January’s large positive surprise, consensus expects an unchanged number.

- Import prices (Wednesday):Dominique expects a 10bp contraction. So far, we have seen little impact from the Red Sea quagmire on import prices.

Markets We Are Watching

- Yields are on the move. We like being short the US10y, aiming for 4.4%. Until CPI, the rates market is likely to be muted, but watch for a spike if CPI beats.

- In equities, we’re looking beneath the surface for signs of exhaustion. Market internals have been mixed – as the percentage of stocks above their 200-day moving average has fallen since the start of the year, however, cyclical stocks have outperformed defensives.

- In commodities, we’re watching gold carefully this week. We’ve been bullish on gold, but recent hawkish data has put the yellow metal under pressure. Further downside is possible when yields and the dollar rise together.

Europe & UK: Uncertainty Stems From Methodology, Reweighting

This week sees ECB and BoE speakers, plus labour market and inflation data for the UK. We still think the BoE will cut in May, though our conviction has decreased lately. Upside surprises in this week’s data would likely delay the cut.

- UK unemployment and wage growth (Tuesday): unemployment has downside risks due to changes in ONS methodology – we will read little into the print despite potential for a decline to drive a strong market reaction. More important will be private regular wage growth, which Henry expects to rise slightly.

- UK inflation (Wednesday): reweighting factors will likely support headline and cause considerable uncertainty in the aggregates. Excluding this effect, Henry expects a slight beat in headline vs the BoE forecast of +4.1% and an undershoot (about +5.1%) for core vs the BoE’s +5.5%.

- ECB, BoE comments: BoE Governor Bailey and External Member Greene speak – has the tone around the labour market changed since the LFS revision? Meanwhile, the ECB’s Lane accompanies several other speakers, with the main message likely to be that inflation may miss near-term, but medium-term risks abound.

Markets We Are Watching

- Gilt yields have risen sharply since the turn of the year with the 10y now above 4%. Like the US, we’re watching 10y Gilt yields in the UK ahead of CPI on Wednesday.

- Relatedly, UK homebuilders have been relatively resilient this year despite higher yields. However, a further increase will put the sector under further pressure which could be a bad sign for future demand. Stronger growth isn’t enough for to sustain homebuilder earnings, right now the impact of interest rates is more important.

$-Bloc and Rest of G10 Europe: Will Orr Confirm an RBNZ Hike?

This week brings important business confidence data in Australia and a speech from Governor Orr in New Zealand. We also get speeches from policymakers in Norway and Sweden, but they are unlikely to provide much useful information.

- Australian NAB Business Survey (Tuesday): While the initial headline scores for the survey are useful, we will focus on the details. Through December they showed a sharp decrease in retail prices alongside further progress in purchases costs. Meanwhile, demand remained weak.

- RBNZ Governor Orr (Monday and Thursday): ANZ now expect a February and April hike, and Governor Orr could guide us towards this. However, we still think they will not tighten this month and that long AUD/NZD will make sense as RBNZ hawkishness is unlikely to outlast RBA hawkishness.

Emerging Markets: Election Race Concludes in Indonesia

Extended holidays in Asia due to Lunar New Year and Carnival in Brazil mean a quiet week in those regions. Elsewhere, the big event is Indonesia’s elections, while Bangko Sentral ng Pilipinas sets policy on Thursday. Israel, Poland, and Czechia all see inflation prints.

- Indonesia elections (Wednesday): The polls will determine the next president, VP, and legislature (upper and lower house). Prabowo/Gibran have strengthened their lead in the president/VP race. The latest polls indicate the pair could win by a slim majority. If no ticket wins a majority vote, a run-off will be held on 26 June.

- BSP policy meeting (Thursday): BSP is likely to hold its overnight borrowing rate at 6.5%. The Finance Secretary often comments on monetary policy and has indicated that the BSP will cut once the Fed starts cutting.

Key Market Movers From Last Week

Bilal Hafeez is the CEO and Editor of Macro Hive. He spent over twenty years doing research at big banks – JPMorgan, Deutsche Bank, and Nomura, where he had various “Global Head” roles and did FX, rates and cross-markets research.

Viresh Kanabar is an investment strategist with 8+ years of experience, notably contributing to portfolio construction and risk management at CCLA Investment Management, a £12 billion fund. Viresh was also a voting member of the Investment Committee and ran the private asset valuation process.