This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

Summary

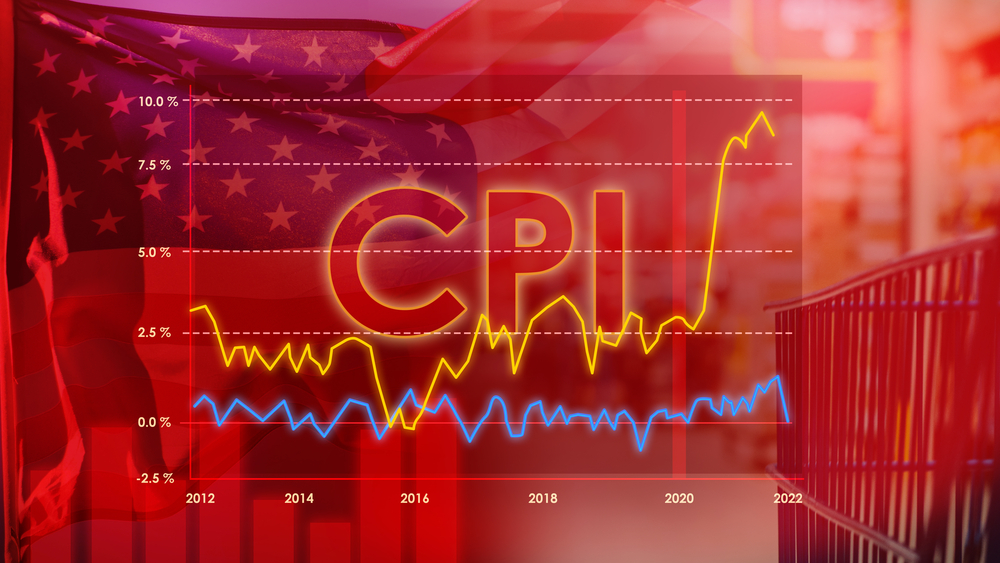

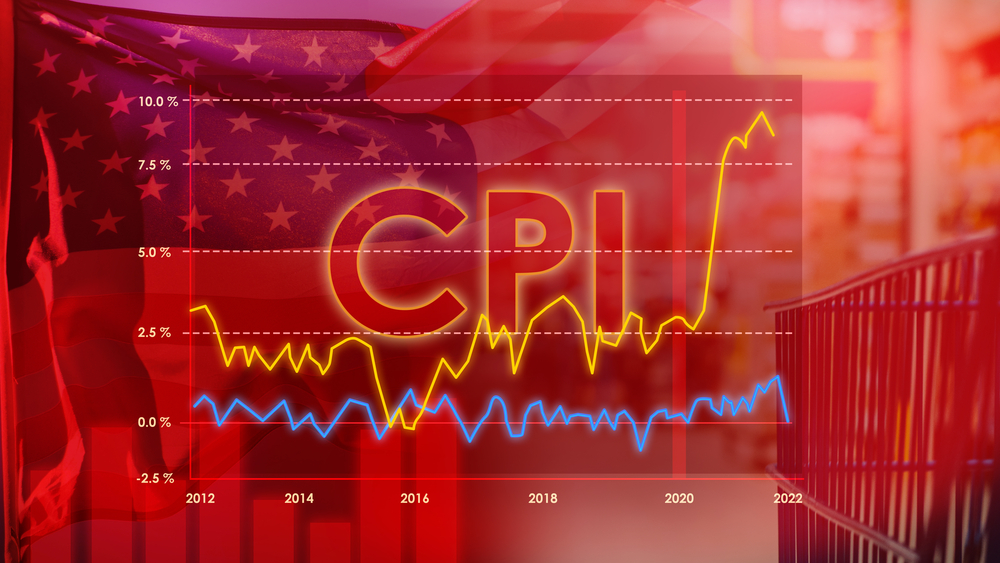

- The US sees CPI and PPI data this week – both likely to be consistent with a June cut from the Fed.

- In Europe, the ECB sets policy on Thursday. We expect rates on hold with an optimistic tone to prevail until they get March’s final inflation print.

- New Zealand’s central bank meets on Wednesday. They are unlikely to commit to cutting without confirmation the recent core inflation beat was a one-off.

- Emerging markets get three central bank meetings this week (MAS, BSP, and BoT), while the highlight in Brazil is the March IPCA on Wednesday.

US: ‘A Sometimes Bumpy Path’

Fed Chair Powell’s latest view is of ‘solid growth’, a ‘strong but rebalancing’ labour market, and inflation heading to 2% on a ‘sometimes bumpy path’. We still expect the first Fed cut in June despite the bumper NFP print last week. The latest PCE figures support this. Yet signs of slower productivity growth will likely lead to higher 2025 dots. This week:

- March CPI (10 April): Expect 0.3% core MoM and a further slowdown in housing inflation from 44bp in February.

- March PPI (11 April): With the PPI, we will have an estimate for PCE. We only need MoM core PCE to be 28bp or below for YoY March core PCE to print 2.7% or below, down from 2.8% in February. That would support a June cut.

- April U Mich. consumer confidence (12 April):we agree with the consensus that sees confidence moving sideways, consistent with continued strong demand for durables.

Markets We Are Watching

- Ultimately, core CPI will decide market direction this week. A beat will put further pressure on the STIR market, which is now pricing in slightly less than the three cuts laid out in the SEP.

- We watch SOFR Z4 futures, as a beat could lead to further cuts being priced out of the curve. We also monitor the Z4-Z5 spread, as the 70 bps cuts priced by the market look far too high for a US economy where growth remains robust.

- The dollar has been crying out for volatility to break it out of its recent trading range. EUR/USD for instance has been trading closely around 1.08. On one hand, a cyclical recovery in manufacturing should lead to a stronger EUR. However, a third hot CPI print in the US should further widen yield differentials, in favour of a stronger USD.

Europe & UK: ECB to Leave Rates on Hold, Teeing Up June Cut

Last week’s most important data was the Eurozone preliminary March CPI. Core missed (+2.9% YoY vs +3.0% expected), as did headline (2.4% vs +2.5% expected). While appearing dovish, March is typically volatile, and Q1 data overall shows core remains strong. This should concern the ECB, which meets this week.

- The ECB meets on Thursday. We expect a hold, with the first cut in June. Despite the weak outturn in headline inflation, President Lagarde may comment on the strong March MoM services inflation.

- France, Spain get final CPI on Friday. This will offer key clues on the worrying March services print. Could Easter celebrations have prompted higher air fares and hospitality prices?

- BoE forecast review due Friday. The review may prompt a more granular, scenario-based analysis. There is also the question of adding dot plots. Few think that will add value, but more detail on policy rate outlooks by voter could be useful.

Markets We Are Watching

- European equities are now outperforming their US peers this year as the cyclical recovery becomes clearer. As it’s ECB week this week, we’re paying particular attention to the European financials which have performed well during a period where expectations of a rate cut have risen.

- Elsewhere, we continue to watch the spread between EUR2Y OIS vs. GBP2Y OIS. The spread has been awfully stable at around 130 bps, but with signs that the UK labour market is loosening faster than in Europe, we could see this spread move in favour of EUR rates in the coming weeks.

Rest of G10: RBNZ Needs More Data Before Cutting

The Reserve Bank of New Zealand meets Wednesday. We expect rates on hold as the bank need confirmation that the recent core inflation beat was driven by one-offs. Q1 CPI on 16 April will be their next indication.

We continue to watch Japan’s MoF for signs of actual intervention following several days of verbal intervention. Recent comments include ‘obvious clear speculative moves’, ‘US-Jp rate differentials are narrowing’, ‘will take appropriate actions’, and ‘4% FX moves in two weeks are not moderate.’

Markets We Are Watching

Verbal intervention from the MoF has previously marked local tops in USD/JPY. We expect the same this time and are bearish the pair. Rising oil prices are a risk, however – they typically see USD/JPY rise.

Emerging Markets: Central Banks Stand Pat

Emerging markets see policy meetings from the Monetary Authority of Singapore (MAS), Bangko Sentral ng Pilipinas (BSP), and Bank of Thailand (BoT). We expect little excitement from any of them:

- MAS meets 7-12 April. We expect the central bank to retain all policy settings, keeping the slope, width and level for the S$NEER policy band. The main factor for a hold is the recent inflation flareup, with February headline rising to 3.4% year-on-year and core inflation jumping to 3.6% YoY.

- BoT meets 10 April. We expect the benchmark rate unchanged despite government pressure to cut. BoT has indicated the policy rate is at neutral, though it has acknowledged scope to ease if growth weakened.

- BSP to hold at 6.5%. BSP has indicated they will follow, not lead, the Fed in cuts and that they expect inflation to exceed the 2-4% target band in coming months.

- Brazil gets March IPCA on Wednesday. We monitor whether food inflation pressure fades. We also watch core services as the BC closely follows it. Despite the more benign behaviour on YoY basis, core services remains a source of concern for the central bank.

Key Market Movers From Last Week

Bilal Hafeez is the CEO and Editor of Macro Hive. He spent over twenty years doing research at big banks – JPMorgan, Deutsche Bank, and Nomura, where he had various “Global Head” roles and did FX, rates and cross-markets research.

Viresh Kanabar is an investment strategist with 8+ years of experience, notably contributing to portfolio construction and risk management at CCLA Investment Management, a £12 billion fund. Viresh was also a voting member of the Investment Committee and ran the private asset valuation process.