Key Events

G10

In the US, there is…

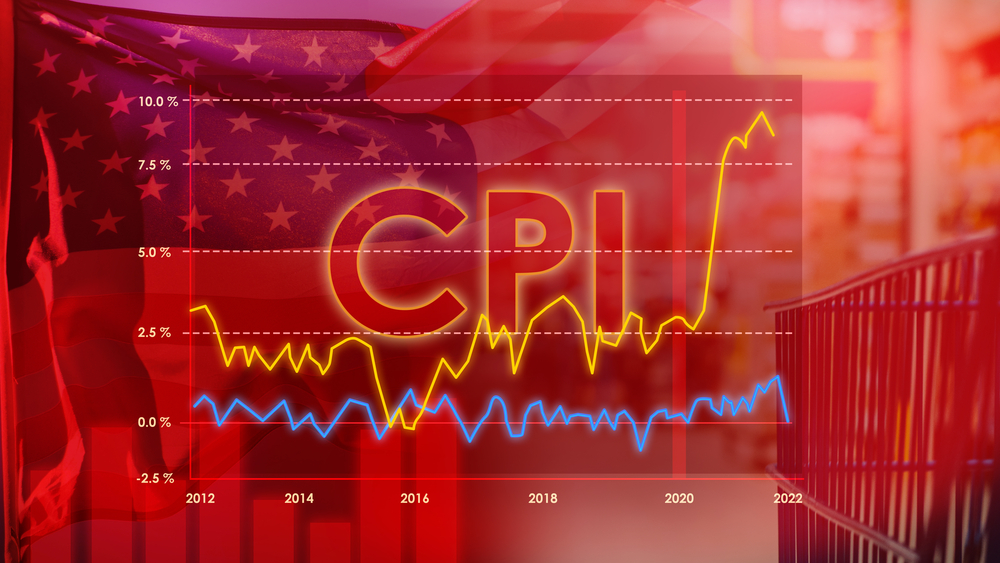

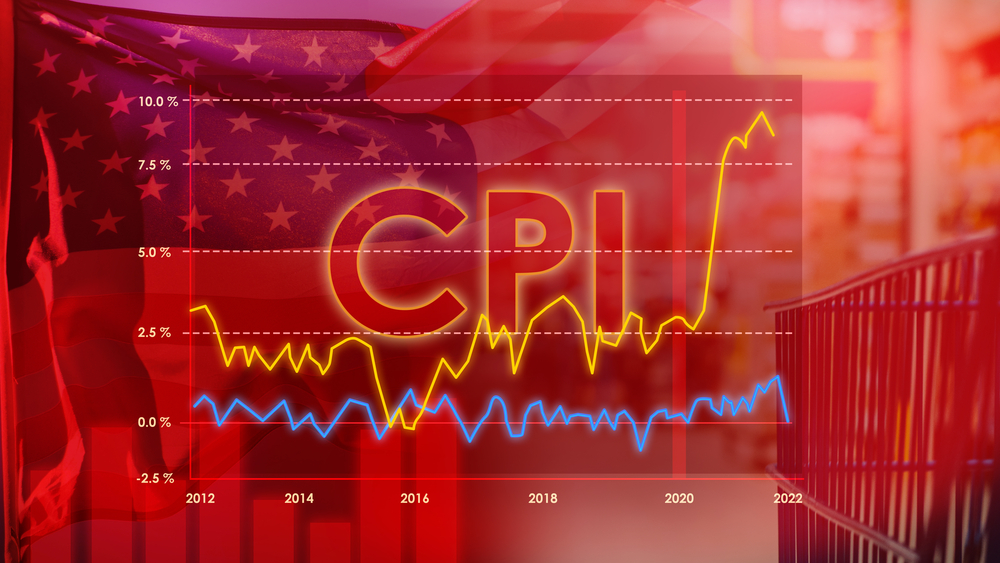

- CPI – Wednesday. From a trading perspective, CPI is the more important release (for market impact, see our Event Monitor). From an economic and Fed perspective, it is the CPI/PPI combination that matters because they will give us an estimate of core PCE, the price index targeted by the Fed. This will be the first of two inflation prints ahead of the December FOMC. As long as the average core PCE for the two prints is below 25bp, my base case, I expect the Fed to cut in December (see FOMC review).

- Retail sales – Friday. I agree with the consensus 0.3% MoM for the control group that follows a large increase, 0.7% MoM, in September. The Biden administration tightened border controls in June, which has likely ended the immigration surge. This is bound to translate, eventually, into slower consumption growth.

In the Eurozone and UK, the main events will be:

- UK labour market data – Tuesday. The BoE has revised down their expectations for unemployment but kept private regular wage growth expectations largely unchanged despite recent misses. The market is looking for a continued slowdown in regular pay. The details are what matters most – a December cut will require continued misses similar to what has been seen since the August MPR.

- UK September monthly and preliminary Q3 GDP – Friday. The BoE is looking for +0.2% QoQ in Q3, and the market agrees. We will be watching for how much consumption spending contributes to the growth.

- Final German, French, Italian, and Spanish October CPI – throughout week. There is little expectation for changes to the preliminary outturns. The detail of the beat in the preliminary reports will be important though.

Elsewhere in G10:

- Australia labour force survey – Thursday. Consensus expects unemployment to trickle up to 4.2%, from 4.1%. Short of a surprise, the labour market numbers matter little at the moment, with increases in unemployment driven by supply.

EM

- Chinese data (CPI, aggregate financing, IP, retail sales). With some positive signs in property transactions and services PMI last week, markets are watching for signs of recovery as stimulus starts to kick in. As such, we will pay close attention to the usual monthly data dump and aggregate financing data next week.

- India trade balance and CPI. The trade balance likely widened in October thanks to a seasonal demand surge for gold (weddings). Overall, the deficit is on a widening trend, and with foreigners exiting Indian equities, adding to downside pressure on INR. CPI is likely to increase to around 6% due to a rise in edible oil and vegetable prices.

- Czechia inflation – Monday. Any upside surprise versus the CNB’s 2.8% forecast could see a near-term pause on easing.

- Hungary inflation – Tuesday. Disinflation to end with unhelpful base effects and recent FX weakness.

Central Banks in Action

- Bank of Mexico to cut 25bps to 10.25% – Thursday. We expect another split decision to cut rates by 25bps, and flexible forward guidance around data dependency.

- BCB meeting minutes – Tuesday. BCB sped up rate hikes to 50bps this week. We expect the minutes to reflect on underlying inflation, FX pass through and policy credibility.

Markets to Watch

- We are watching pricing of ECB cuts – right now the market looks too dovish again, but the risk-reward is not worth fading just yet.