Key Events

G10

In the US, there is…

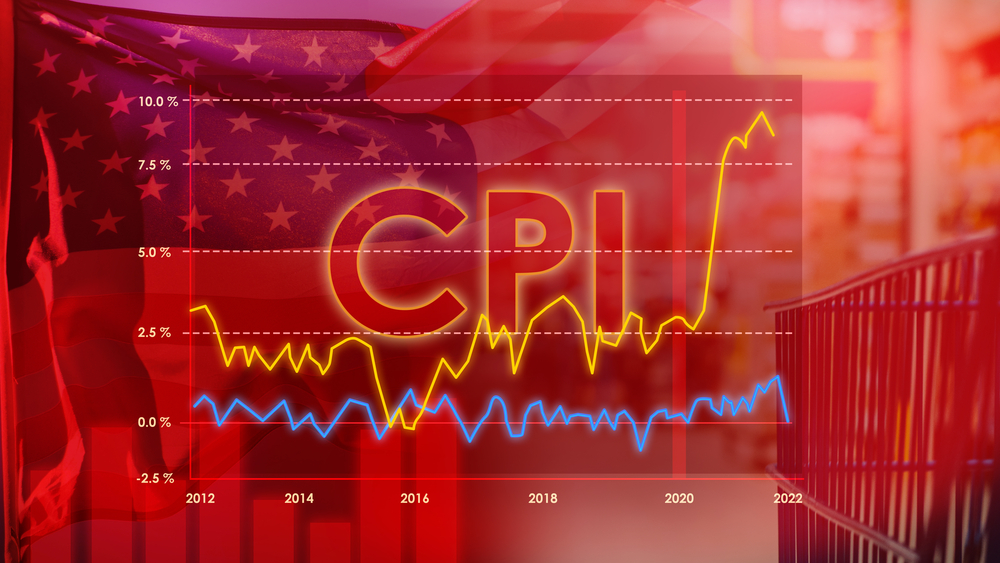

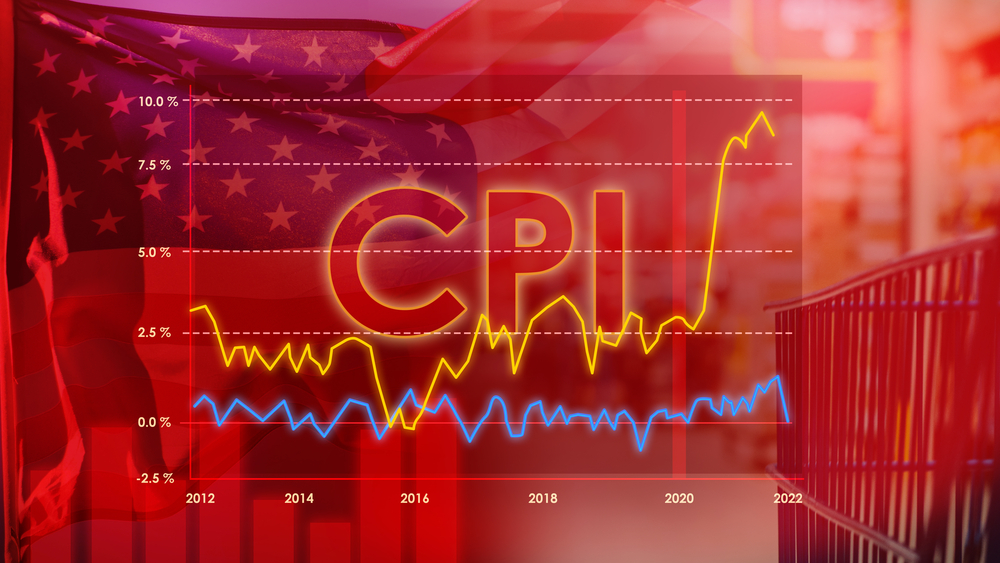

- CPI – Wednesday. Consensus expecting rangebound CPI (2.9% core YoY) makes sense. Thursday’s PPI will provide an estimate for core PCE that I also expect to be near the current 2.6-2.8% range.

- Retail sales – Friday. The control group consensus (used to estimate consumption in the GDP data) is 0.4%, which seems plausible given the strong labour market data.

In the Eurozone and UK, the main events will be:

- Preliminary Q4 UK GDP – Thursday. The market is looking for –0.1% QoQ. The monthly readings suggest it will be near flat. Downside surprises would add to our feeling the UK economy is already turning over.

- Final January German and Spanish CPI – Thursday and Friday. The detail of the services beats will be interesting to see, particularly if there is a strong wage-intensive component. We still expect inflation can overshoot ECB expectations.

- Preliminary Q4 EZ GDP – Thursday. The market is looking for growth to have been flat in Q4.

Elsewhere in G10:

- Switzerland CPI – Thursday. We expect another month of weak inflationary pressures. However, risks exist that this theme slows significantly. February and March have been stronger months for core inflation excluding housing while pricing expectations have risen rapidly in previous months.

EM

- China CPI – Monday. The Lunar New Year mismatch is expected to increase January CPI YoY by around 0.2% based on the average rise in previous mismatch years. However, high-frequency data suggests a decline in food CPI, instead of an average increase of 0.73% in previous years. We expect a moderate rebound in the CPI to 0.3% from 0.1% in December.

- China PPI – Monday. High-frequency domestic commodity prices and PMI components indicate a sideways movement in the PPI of around -2%.

- Czechia CPI – Wednesday. Inflation will be in focus for potential revisions after the first flash CPI release on 6 February.

- India CPI – Wednesday. Continued disinflation should allow the RBI scope to continue easing.

- Poland CPI – Friday. With the NBP still firmly on hold a move higher in inflation will not change the rates outlook.

Central Banks in Action

- Fed Humphrey-Hawkins testimony – Tuesday (Senate)/Wednesday (House). I expect Chair Jerome Powell to say the Fed is sticking to its current easing plans and that the Fed needs more information about the Trump administration’s policies to assess their impact

- Hammack (Non-Voter, Hawk), Williams (Voter, Dove) – Tuesday. I expect them to follow previous FOMC speakers in explaining a longer wait and see period is needed to take the measure of the administration’s policies.

- BoE Governor Bailey (Tuesday) and hawkish external-members Mann (Tuesday) and Greene (Wednesday) speak. Extra information from Bailey is unlikely, and Mann’s rationale for switching from no cut to 50bp is unlikely that important. Greene’s rationale for switching to a cut could be more interesting. It will probably be due to her fears of a consumer bounce back falling in probability (as we predicted). Interesting will be whether the external hawks now see the need to cut to neutral rate.

- ECB’s Lagarde (Monday), Schnabel (Tuesday) and Nagel (Wednesday) speak. Nagel’s speech could be the most interesting. We have heard a lot from the doves on where the neutral rate is, now it will be interesting to hear from him. I expect he sits around 2.5%, which could make the post-March decisions more contentious.

Markets to Watch

- USD will likely endure another week of volatility with US CPI, PPI and retails due. This is without Trump talking, too! We remain bearish.

- The bearish CHF theme will continue with CPI likely to prove weak again. However, the path to broad weakness is slimmer than thought and may slow.