In this episode, I talk markets with Juliette Declercq. She’s a leading macro strategist and runs JDI research. She has close to twenty years market experience, including stints at J.P Morgan, Morgan Stanley and Stone Milliner.

On the podcast, we discuss:

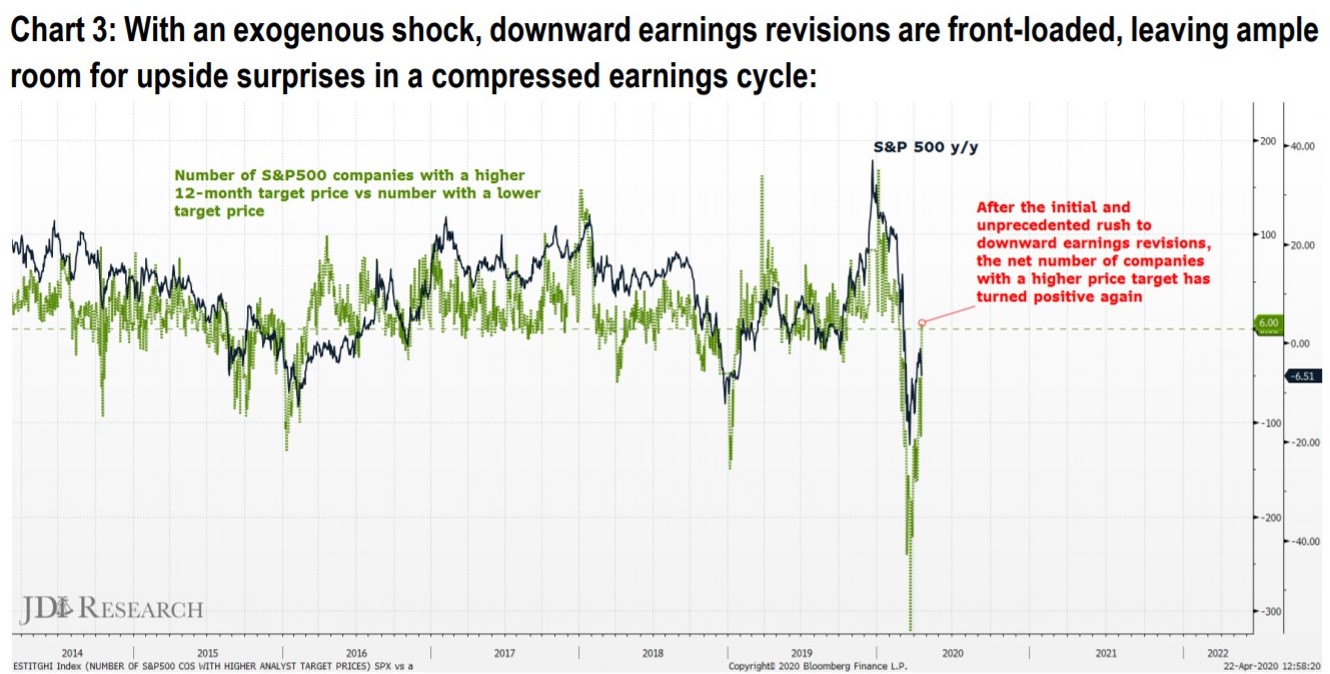

1. Why past recessions are not a guide to the COVID crisis

2. Why P/E ratios are a poor guide to equity valuation

3. Not putting too much weight on weak employment data

4. Why Euro-area break-up trades are not attractive

5. Her view on the dollar and euro

6. The prospects of inflation.

Juliette gives a refreshing and original take on markets, so make sure to listen till the end. You can find her chart reference below and reach her at [email protected].

Make sure to subscribe to the show on Apple, Spotify or wherever you go for your podcasts. You can follow us on Twitter and LinkedIn.

*Referenced to at the 11th minute in the podcast

(The commentary contained in the above article does not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.)