As the world concentrates on natural gas and oil prices, uranium has doubled this year. The move follows a 10-year secular bear market after the nuclear accident at the Fukushima Daiichi nuclear power plant in 2011. Having hit a low of $19/lb, uranium recently touched $50/lb, with +50% of those gains generated in the last two months.

Hedge funds and the Sprott Physical Uranium Investment Trust (SPUT) catalysed the recent gains. Since launching in August, SPUT has quickly run through its initial $300mn AUM and has accumulated $1.5bn worth of uranium. SPUT is now the world’s largest physical ETF.

This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

As the world concentrates on natural gas and oil prices, uranium has doubled this year. The move follows a 10-year secular bear market after the nuclear accident at the Fukushima Daiichi nuclear power plant in 2011. Having hit a low of $19/lb, uranium recently touched $50/lb, with +50% of those gains generated in the last two months.

How SPUT Is Impacting the Uranium Market

Hedge funds and the Sprott Physical Uranium Investment Trust (SPUT) catalysed the recent gains. Since launching in August, SPUT has quickly run through its initial $300mn AUM and has accumulated $1.5bn worth of uranium. SPUT is now the world’s largest physical ETF. For context, the 32.4mn lbs it has bought since mid-August equals 26% of the 2021 mined supply. Meanwhile, earlier this week, Kazatomprom (KAZ; the world’s largest producer and seller of natural uranium) announced their participation in a Kazakh physical uranium fund ANU Energy. Sourced from itself and backed by the Kazakh government, it will look to purchase $550m, which at current spot pricing equates to 10.5% of current market supply.

Financial players are clearly accelerating price discovery in a thinly traded spot market, but this would not be occurring were there not a fundamental supply deficit.

The Supply and Demand Balance for Uranium

The key now will be how the world’s nuclear power plants respond. To them, uranium is completely price inelastic – they must have it. They are also price agnostic – uranium represents only around 5% of a nuclear plant’s ongoing costs. As history showed in 2007, they will pay $137/lb as readily as $20/lb because, if they ever run out, the restart costs of a nuclear plant are hundreds of millions of dollars.

This price inelasticity of demand helped start a bull market that saw uranium’s price explode. It went from around $23/lb in 2006 to peak at $137/lb in June 2007. The trigger was the flooding of Cameco’s (CCO) Cigar Lake in October 2006. There was a 70mn lb surplus then. This time, there is a 55mn lb deficit. Mined uranium supply is 125mn lbs this year, and demand is 180mn lbs. With the electrification of everything and the nuclear renaissance, the World Nuclear Association (WNA) expects this demand to be 292mn lbs in 2040.

In 2007, just like today, it was the hedge funds and financial buyers that stood in front of the utilities and forced them to pay more than $130/lb.

2007 witnessed a 1,000x share price increase for the miner Paladin Energy and large-cap Cameco went from under $4 to $60, so returning 15x. The universe of uranium stocks in 2007 was $150bn. Today, it is circa $50bn, and half that when you strip out KAZ and CCO. That is why this time, everyone will crowd into a much smaller room.

SPUT and Uranium ETFs

SPUT could single-handedly remove all supply, preventing it from reaching nuclear utilities. And SPUT is not alone in sequestering. Yellow Cake announced in August it had purchased 2mn lbs from KAZ. Yellow is an LSE-listed physical ETF that sits on 15mn lbs of uranium stored in a Cameco facility in Ontario. Uranium Royalty Corp also announced their intention to buy. In addition, KAZ and CCO recently told the market they will be sizeable buyers of uranium to make up for lost production due to Covid shutting their mines.

KAZ CCO Askar Batyrbaev said last month at the WNA Symposium that potential uranium supply is not guaranteed, and ‘there is a risk that there may not be enough material to satisfy all existing global demand in the mid- to long-term.’

The fundamentals are now the tightest they have been. But the number of uranium sector stocks has dropped from 600 in 2007 to circa 50 publicly traded names today, and their commensurate market cap has fallen from $140bn to $40bn.

I think this rally has only just started. It took under a year last time for uranium to increase sevenfold in price, and so far, we have only doubled from this year’s lows.

2022 Update on the Uranium Market

We recently published an updated view of the uranium market on 21 March 2022, titled, The Uranium Upside. It explains how recent news on uranium and the evolving macro backdrop leave us bullish on the heavy metal. For example, US President Joe Biden is considering banning Russian uranium, and Bill Gates’ nuclear energy company is refusing to purchase from Russia. Meanwhile, several countries are clinging to nuclear for their power needs. You can find our latest views on uranium stocks, the physical uranium fund SPUT, and which companies look attractive.

Meanwhile, earlier in 2022, we explored the impact on uranium from protests in Kazakhstan and EU changes. We cover uranium miners, spot prices, and supply-chain issues that could still affect the market today.

And finally, check out our recent podcast with Amir Adnani, CEO and founder of Uranium Energy Corp, published on 12 January 2022. In it, we discuss whether nuclear is a core part of the green revolution. We also give an overview of the uranium market and major players such as Uranium Energy Corp and Uranium Royalty, and we cover uranium prices and different uranium stocks.

You can watch the video of our podcast with Amir Adnani below, in which we ask: is now the time to buy uranium?

FAQ

→ What is uranium?

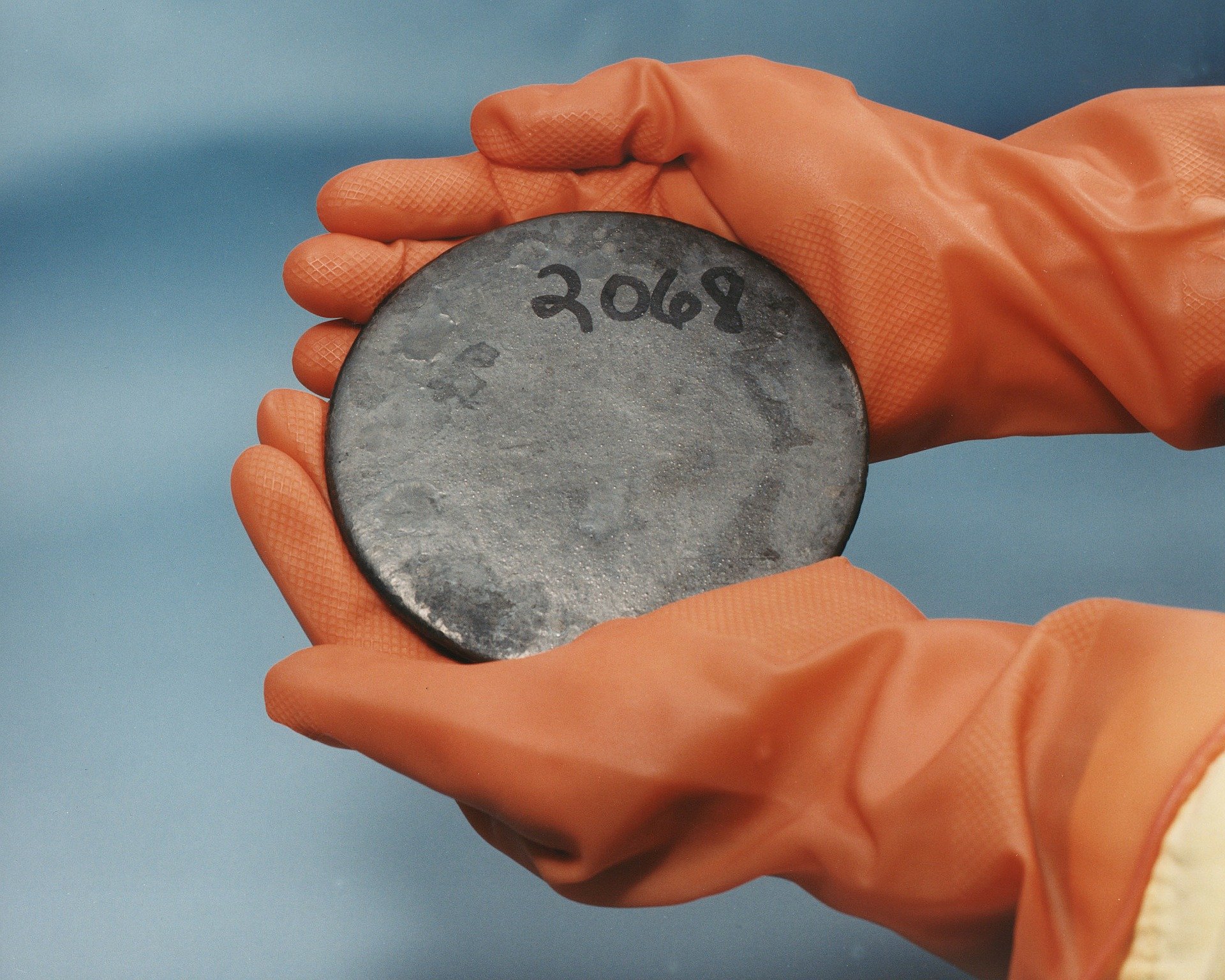

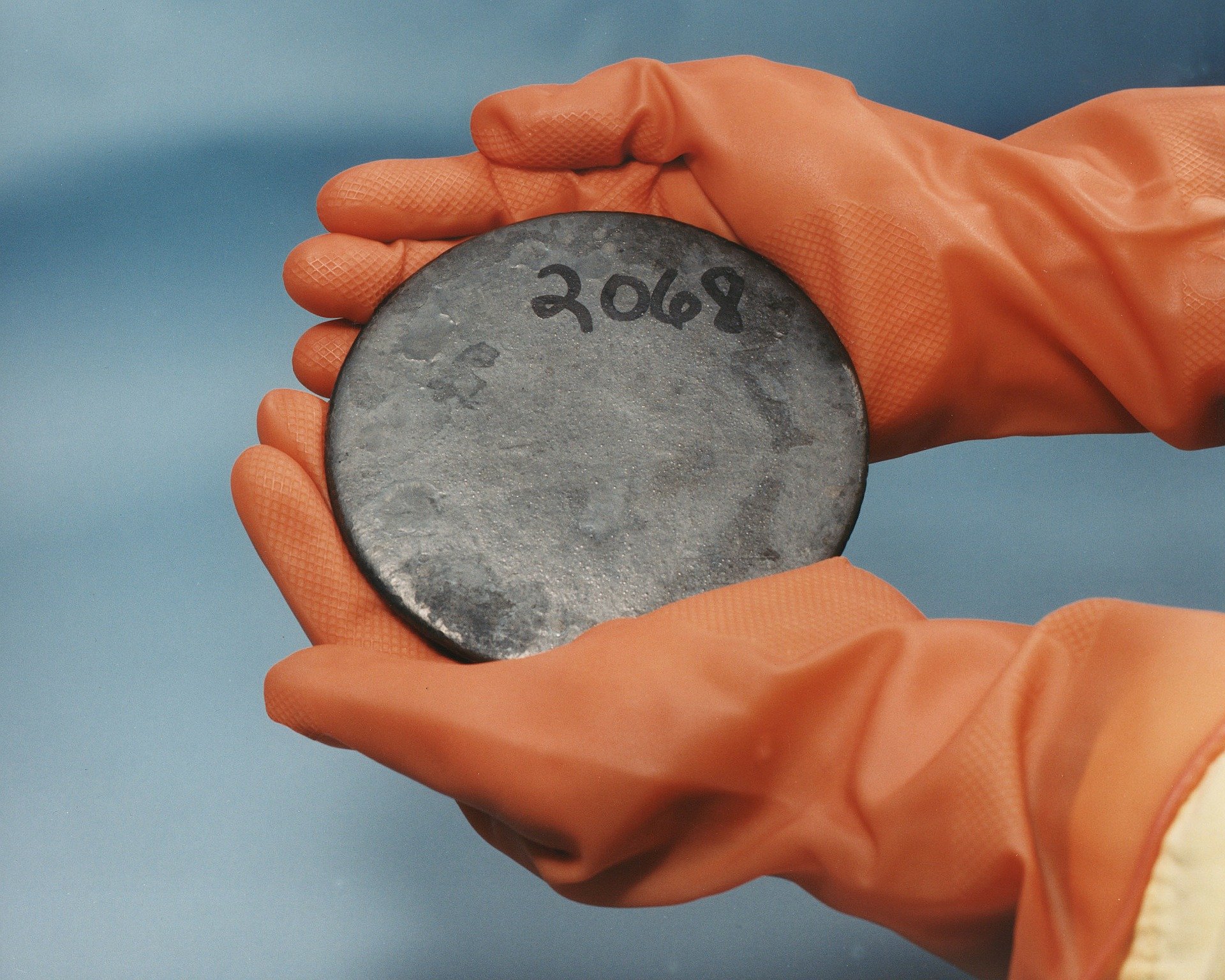

Uranium is a fairly common metal used in the production of fuel for nuclear power plants. These power plants generate significant electricity with life cycle carbon emissions comparable to renewables. As such uranium plays an important part in the global energy industry.

It is possible to mine uranium ore from underground. It can subsequently be milled and sold for use in nuclear reactors. About 10% of global electricity comes from uranium in nuclear power plants.

→ What is uranium used for?

Uranium is used for fuel in nuclear power plants. It will be important to the green transition, and it is increasingly being seen as a possible replacement for oil and gas given the price pressures exerted by the Russia-Ukraine war. These rising energy costs in addition to the focus on a carbon-free future for power generation will probably increase demand for nuclear power and consequently uranium.

Nick Lawson is the Founder and CEO of the investment house Ocean Wall. Ocean Wall specialises in niche alternatives and in 2020 was rated ‘Best niche alternative advisory firm’ by HFM, the global hedge fund magazine. Before Ocean Wall, he was Partner and Head of Strategic Capital at Arrowgrass Capital. Prior to that, he ran the merger arbitrage and special situations platform at Deutsche Bank.