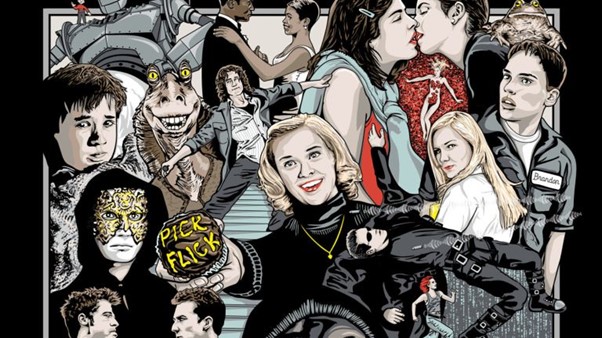

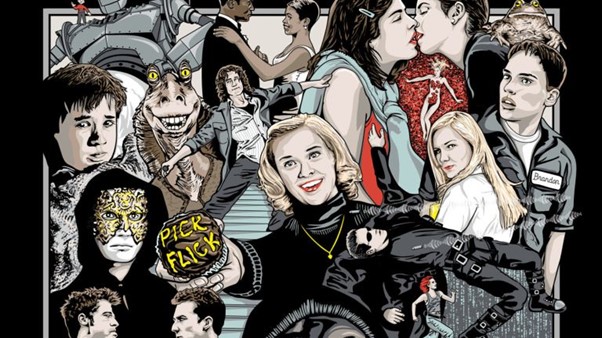

The Matrix. The Sixth Sense. Fight Club. The Insider. Magnolia. Need I say more. For various reasons, the last year of the millennium saw an outpouring of auteur-driven filmmaking. Movie genres were redefined: was The Sixth Sense a horror, thriller or ghost story? What was Fight Club or Being John Malkovich? And new genres were invented like the horror pseudo-documentary – The Blair Witch Project.

Part of this creative outpouring could be traced back to Quentin Tarantino’s 1994 Pulp Fiction. It was a critical and box office success which gave studios the confidence to experiment with less conventional movies for years to come.

The decade also saw the increasing anxiety amongst the middle classes, especially men, which allowed movies like Fight Club, American Beauty and Office to touch a nerve. Then there was the rise of the internet and fears of the Y2K bug that set the stage for The Matrix. Finally, the year saw the return of heavyweight directors like Stanley Kubrick (Eyes Wide Shut), and Terence Malick (Thin Red Line). It also saw the debut of Christopher Nolan with his film Following.

I learnt all this in Brian Raftery’s excellent ‘Best.Movie.Year.Ever.: How 1999 Blew Up the Big Screen’. It’s packed with anecdotes and insights on the top movies of that year. Did you know that the first choices to play Neo in The Matrix were Will Smith, Brad Pitt, Leonardo DiCaprio, and Sandra Bullock. In the end, it went to Keanu Reeves. Even funnier was that Arnold Schwarzenegger was considered for the Morpheus character (it went to Lawrence Fishburne).

At the time, many thought 1999 would mark the beginning of a golden era for movies, but instead, it signaled the peak. Y2K, the 9/11 terrorist attacks and the Iraq war resulted in audiences to prefer escapism to being challenged. The rise of the Chinese film audience required less nuance and the success of 2002’s Spiderman began the CGI superhero movie juggernaut. Then there was the shift of creative talent to TV. 1999 was the debut year for The Sopranos and The West Wing.

While the golden era never happened, at least we have the movies made in 1999 – here’s a more complete list to enjoy:

The Sixth Sense

Boys Don’t Cry

American Beauty

The Insider

Being John Malkovich

The Matrix

Magnolia

Fight Club

Three Kings

Run Lola Run

The Blair Witch Project

Eyes Wide Shut

Thin Red Line

Girl, Interrupted

Office Space

10 Things I Hate About You

The Best Man

Star Wars Phantom Menace

The Limey

All About My Mother

American Pie

Election

Rushmore

The Virgin Suicides

Enjoy, Bilal.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.