This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

We track scheduled flights (what’s planned) and tracked flights (what’s in the air) from a sample of the largest airports across the world. Looking at data up to 12 April we find the following:

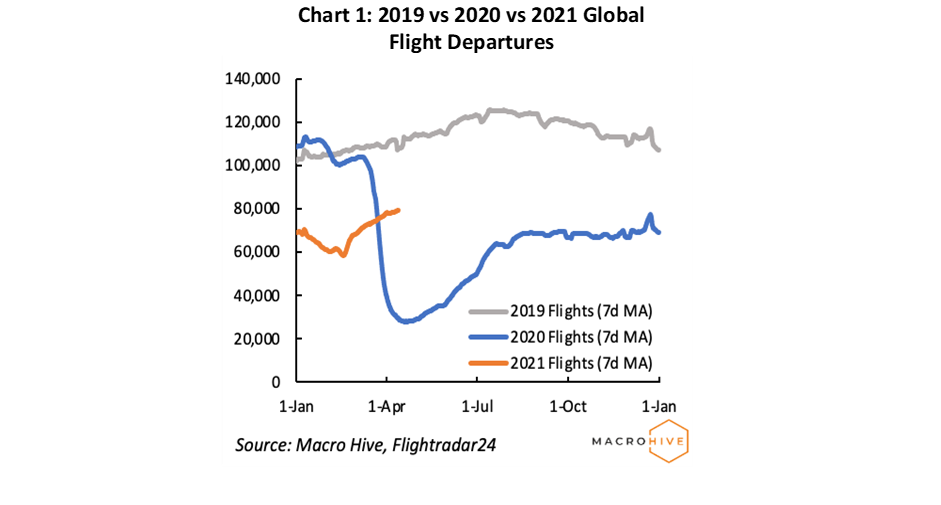

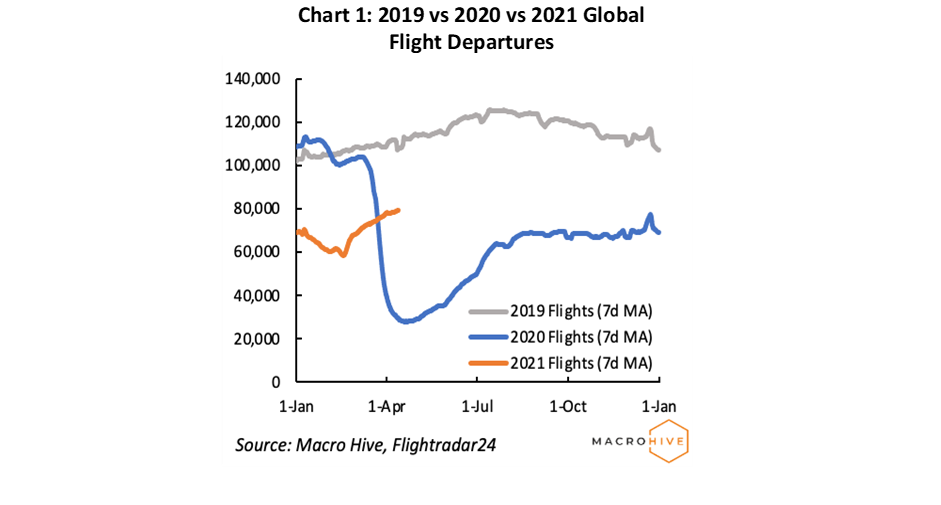

- On Monday, there were 7,653 planned departures and 6,695 actual take-offs, down 0.2% and 1.6% WoW, respectively. Globally, flight departures increased 4% WoW (Chart 1). However, this amounts to only two-thirds of 2019 levels.

- Across our five US airports, average tracked flights were down 0.4% WoW, with actual flights from New York and Chicago down most (Chart 3). However, scheduled flights were up 0.8% WoW, with Atlanta faring best (Chart 2). Overall, there were 3,638 flight departures from our selected US airports, and capacity declined slightly to 69% of pre-COVID capacity (Chart 4).

- Our European airports experienced a significant decrease in flight demand. Scheduled and tracked flights were down 5.8% and 6.3% WoW, respectively, with Barcelona and Madrid driving the negative change (Chart 3). As a result, European airport capacity declined to 26%, and remains far below other regions, with Frankfurt highest (34%) and Gatwick lowest (3%).

- Scheduled flights from Asian airports were up 1.2% WoW, while tracked flights were down 0.3% WoW. Actual flights out of Tokyo Narita decreased most (Chart 3). As a result, overall capacity declined to 59%, with Shanghai highest (96%) and Singapore lowest (17%).

Information on long-term movements in flight data is available at the bottom of the page.

US

UK

Italy

Spain

Germany

France

Canada

China

Japan

Hong Kong

South Korea

Singapore