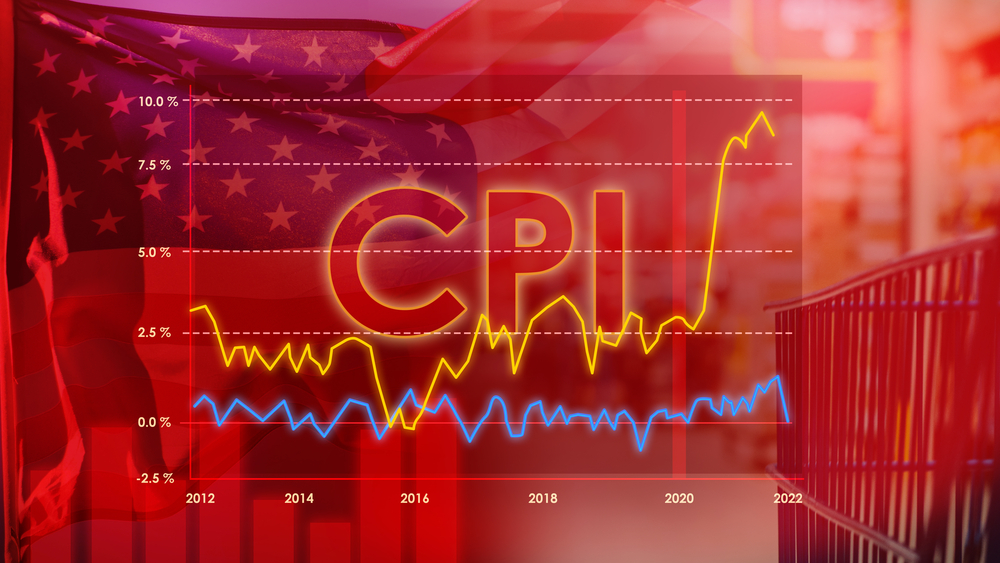

Continued Disinflation With Strong Stocks?

Dominique Dwor-Frecaut

Summary In my view disinflation with strong equity market performance is likely to continue. A post-pandemic productivity pickup is translating into lower labour costs rather than into higher wages, which supports further disinflation but adds downside risks to growth. The income share of profits is continuing to rise, which is translating into rising equity market […]